Your daughter just got engaged. Your old kitchen cabinets are falling apart. It’s November, and you’re not sure how to fit presents into your limited monthly budget.

Here are just some of the scenarios you might face when you need money you might not have. When you don’t have time to save for a big purchase, should you apply for a personal loan or a credit card?

What Is a Personal Loan?

A personal loan is a lump sum of money that you can use to finance a variety of purchases. It’s paid back to the lender in fixed monthly payments, usually over one to seven years. Your credit score will determine the interest rate and terms.

Personal loans are usually unsecured, meaning you don’t have to put up collateral, like property, to receive funding. Instead, lenders agree to the loan based on your creditworthiness and your promise to repay.

What Is a Credit Card?

A credit card is a form of revolving credit, letting you borrow money up to a certain amount (the credit limit). You only use what you need and don’t get a lump sum. If you carry over a balance from one month to another, you’ll owe interest. Cards might have fees and/or introductory interest-free periods.

Key Differences Between Personal Loans and Credit Cards

Both paying off a personal loan and using a credit card responsibly will help build your credit score. Both provide funding; however, the differences between the two make them better suited for different purposes.

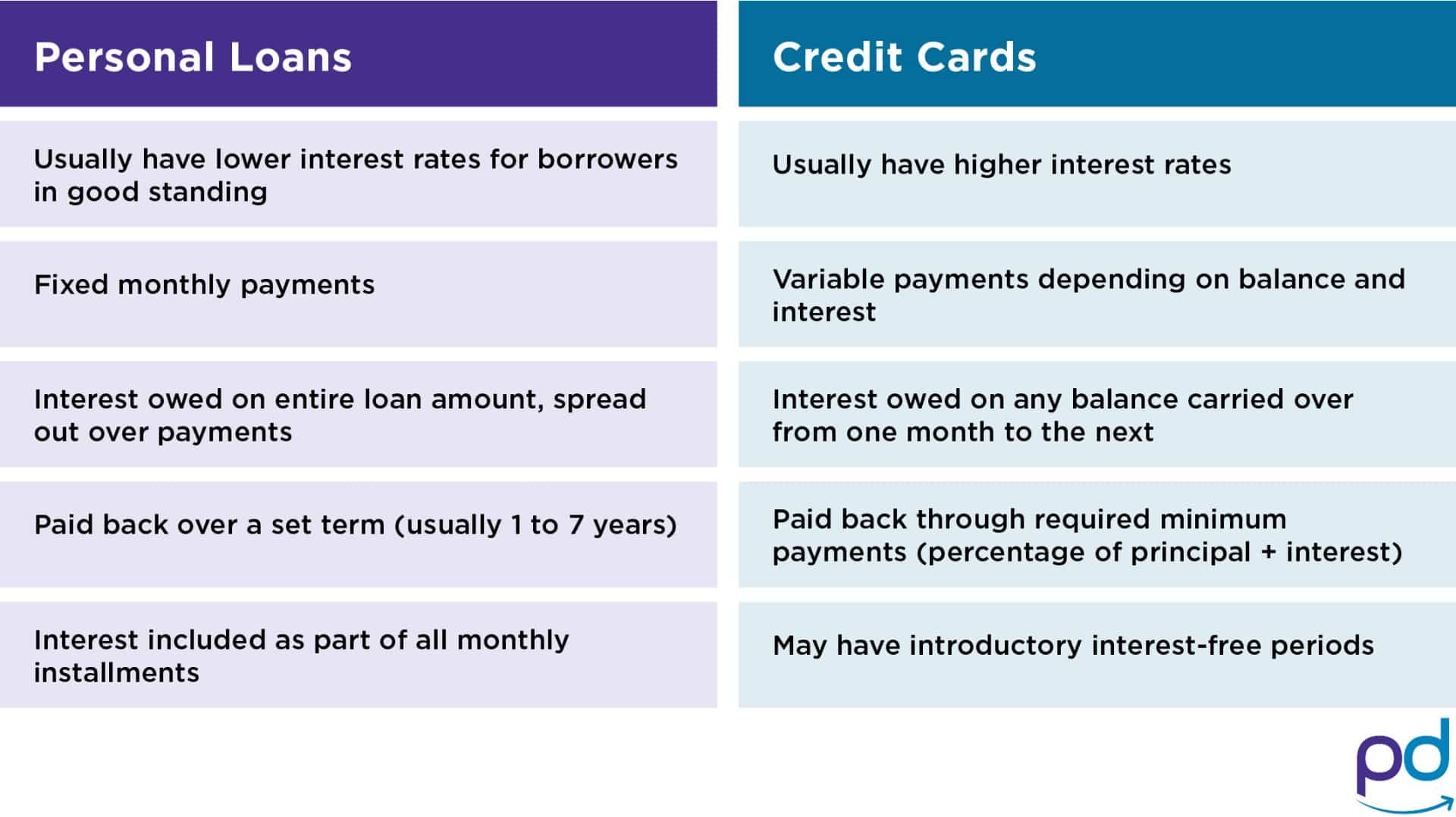

Here are some of the key differences:

Which Is Better for a Big Purchase?

Given these differences, is a personal loan or a credit card better for a big purchase? Let’s dive into a hypothetical example.

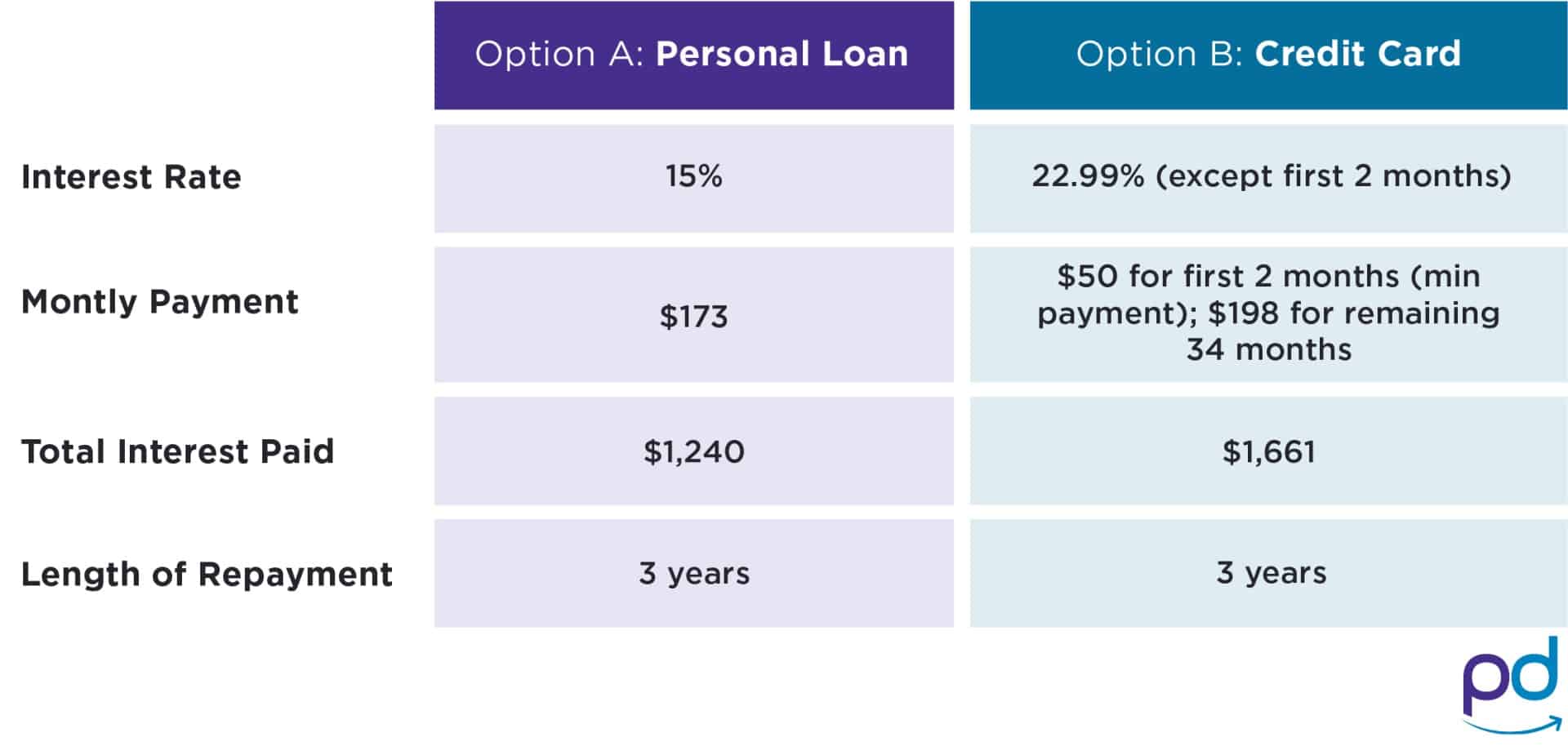

Let’s say you need $5,000. Option A is a three-year personal loan with a fixed interest rate of 15 percent. Option B is a credit card with an introductory interest-free period of 60 days. After that, the annual percentage rate (APR) jumps to 22.99. Perhaps you really want to pay off the debt in three years, regardless of the method you choose.

Here’s the breakdown if you paid back the debt over three years:

In this example, with the lower monthly payment and total interest, the personal loan comes out on top.

Alternatively, you could adopt the same monthly payment for the credit card as with the personal loan (if it worked with minimum payments), but then the repayment would take longer, and you would owe more in total interest.

A credit card with a cushy zero-interest period sounds appealing for large purchases; however, it only makes sense if you can pay the balance in full within the interest-free period. If not, you risk accumulating interest at a higher APR.

Using a credit card like this is also a slippery slope. Once you free up enough space for another large purchase, you might be tempted to dig yourself deeper into a high-interest debt hole. Credit cards are best used for small, everyday expenses that you can pay off by the end of the month, avoiding interest while building your credit score.

A personal loan for a big purchase gives you the security of knowing what your monthly payment will be for the entire life of the loan so you can budget accordingly. You won’t be surprised or struggling to make a large minimum payment.

Give Yourself More Security With People Driven Credit Union

With their predictability, lower interest rates, fixed monthly installments, and differing repayment terms, personal loans make sense for large purchases. If you’re trying to navigate life’s diverse and ever-changing financial needs, People Driven Credit Union is here to help. Our mission is in our name. We’re driven to help our members reach their financial goals.

Enjoy competitive rates, flexible terms, and personalized service when you join People Driven Credit Union and choose us for your personal loan. The application process takes minutes, and you could get your money in as little as a few days. Apply today and end the stress over your next big purchase! To learn more, please contact our Member Services team at (248) 263-4100 or visit a branch.