Making minimum payments on high-interest credit card debt can feel like you’re barely staying on top of the water’s surface. You’re in a precarious position, swimming hard to stay afloat of your finances.

But there’s a life preserver that might help: debt consolidation. When you consolidate your debt through a personal loan, you may be able to lower your monthly payments, pay less interest, and pay off your debt more quickly.

A personal loan from People Driven Credit Union might be the solution you are looking for to get out from under credit card debt. As a member, you have access to our loan consolidation experts, who can help you make smart financial decisions.

What Is Debt Consolidation?

Debt consolidation occurs when you take the lump funds from one loan to pay off other debt, like credit cards and student loans. You trade one kind of debt for another but to your advantage.

People can consolidate debt with either unsecured or secured loans, the difference being whether you put up collateral (secured) or not (unsecured). Each type of loan can make sense depending on your financial situation and creditworthiness.

With thoughtful planning and budgeting, a personal loan can be the lifesaver you need to get out of debt and into financial health.

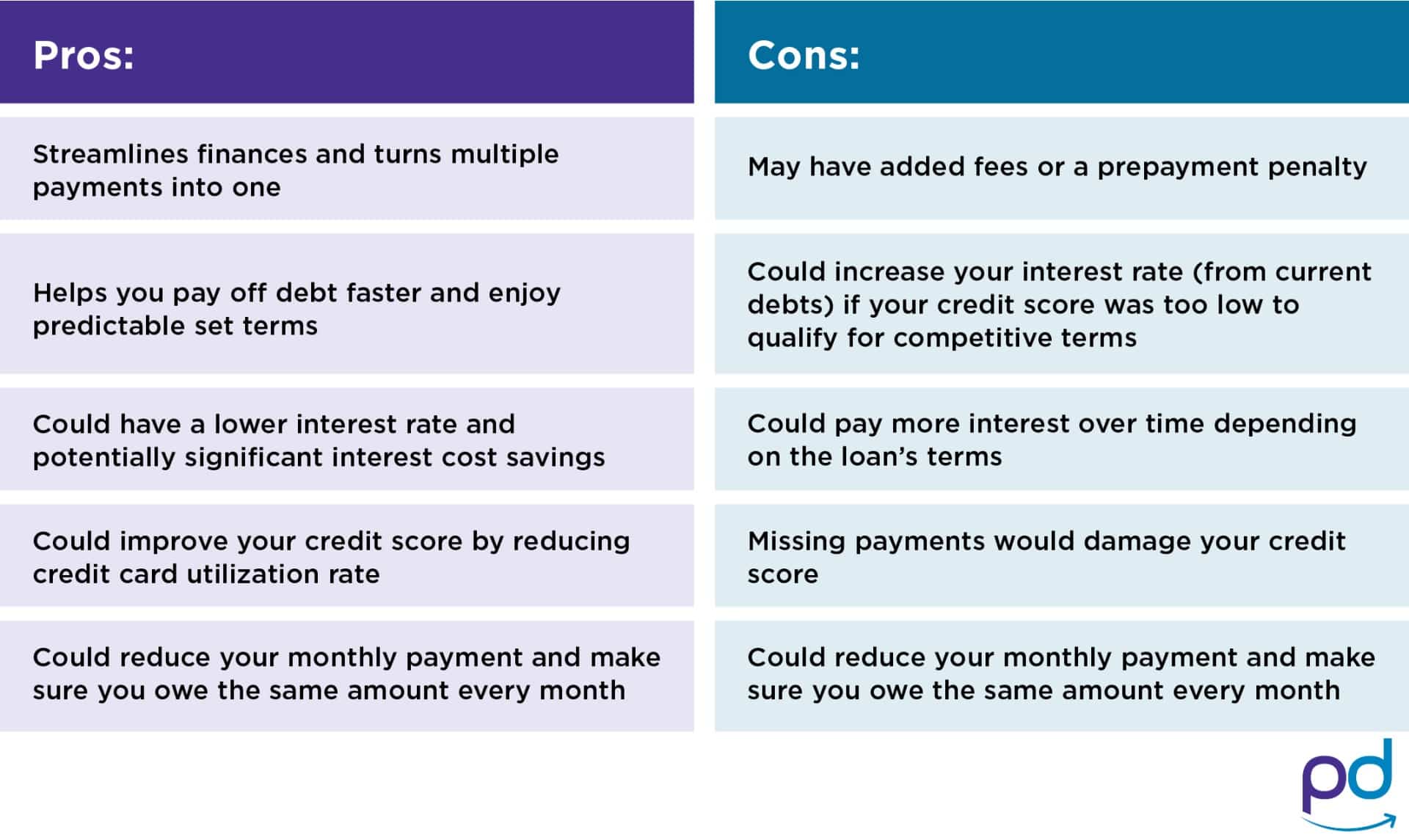

Pros and Cons of Debt Consolidation

As with most financial decisions, debt consolidation has advantages and disadvantages. Here’s a breakdown of the typical pros and cons.

As you can see, there are many reasons why using a personal loan to pay off high-interest debt could benefit your financial situation. Now, let’s explore when it makes sense to apply.

When Should I Use a Personal Loan to Consolidate Debt?

Sometimes, using a personal loan makes sense, and other times, it doesn’t. You can consider debt consolidation if you:

- Can change your spending habits or financial situation to avoid racking up new debt.

- Can manage the monthly payments (which may be higher if you’ve only been paying minimum credit card payments).

- Have a credit score that’s high enough to qualify for a low interest rate.

- Have a substantial amount of debt.

- Want a solid, predictable way to pay off debt with a fixed interest rate.

If you only have a small amount of debt, a low credit score, urgently need help, or can’t address your underlying financial challenges, then a personal loan for debt consolidation may not be for you.

There are lenders, however, like credit unions, who can work with people who have bad or fair credit, so don’t let that one factor deter you. Research your options and choose a lender that fits your needs.

How Do I Get a Debt Consolidation Loan?

Speaking of research, here are the steps you need to take to apply for a personal debt consolidation loan.

Assess Your Finances

List all of your debts and payments. Consider what monthly amount you could handle for loan repayments and how you’ll address underlying financial issues. Calculate your debt-to-income ratio to see if you have a good chance of qualifying. If you have a ratio below 45%, you’ll have better odds for approval.

Check Your Credit Score

PDCU members have free access to their credit reports and scores anytime in the MyPDCU app. Alternatively, you can request free credit reports from the top three credit reporting agencies every year. Just visit AnnualCreditReport.com to get started. A score over 700 gives you a good chance of approval with a low interest rate. If your score is under 700, don’t despair—instead, keep reading.

Research and Compare Lenders

You can get a loan from many lenders, but not all of them are equally good options. Some charge high origination fees and prepayment penalties. Shop around for the lowest interest rates and terms that work for your budget. And ask how quickly you can receive the funds.

If your credit score is low, consider and research a local not-for-profit credit union like People Driven Credit Union. Credit unions are more likely to consider your overarching financial situation and provide superior customer service.

Apply for the Loan

Before applying, collect the necessary information and documents to make the process smoother. Each lender is a little different, but you may need:

- Proof of address (e.g., utility bill, bank statement)

- Proof of income (e.g., W-2s, tax returns)

- Proof of identity (e.g., birth certificate, driver’s license)

Close the Loan

Sign the necessary documents and receive the money in your account. Pay off the debt you want to consolidate and begin making your monthly loan repayments.

Tips on Streamlining Your Finances in the New Year

Christmas is coming, and it’s got a hefty price tag for most families. So how can you make the season bright and still come out the other side fiscally sound?

Remember, consolidating your debt with a personal loan is not an excuse to rack up new debt. If you can’t change your underlying financial problems, you may get caught in a vicious cycle and be in real trouble (if you don’t consider yourself there already).

There are many reasons why you may need debt consolidation, and if overspending and poor money management are among them, here are some tips for getting your finances in order:

- Make a budget. Utilize apps or pen and paper to record, record, record! Every time you swipe the card, note it in your monthly budget. Try to keep spending within your means.

- Automate. Not missing bill payments has never been easier. Set up auto pay wherever possible. Additionally, look into automated savings and investments.

- Consolidate. Do you have multiple 401(k)s from different jobs? If possible, combine them into one account. Do you have five checking accounts? Try one or two instead.

- Increase your gross income. The sad reality is that some people’s incomes don’t cover their bills. Consider your options, whether it’s looking for a better-paying job or starting a side hustle to bring in some extra cash.

- Cut-up-the-cards party. After you pay off a credit card and—hopefully—realize you don’t actually need it anymore, get rid of it! See if you can get by with only one or two.

Turn Over a New Leaf With People Driven Credit Union

Using a personal loan for debt consolidation can be the life preserver you need to manage your financial problems. Getting a personal loan with a low, fixed interest rate may lower your monthly payment, reduce the overall amount of interest paid, and get you out of debt faster.

At People Driven Credit Union, we take our name very seriously. We’re driven to help you with the banking, borrowing, and small business services you need! Our personal loans are tailored to meet your unique circumstances and don’t have any prepayment penalties. The application process takes minutes, and you can get your money in as little as a few days.

Talk to one of our knowledgeable loan experts or apply online today!