Your savings, your way, with Member’s Choice Savings Accounts

Whether saving for a vacation, a wedding, a new car, college tuition, or any personal goal, the Member’s Choice Savings Account gives you the flexibility and control to save for the things that matter most to you.

How It Works:

- Customizable Savings Goals: Open a Member’s Choice Savings Account for each of your financial goals. Save for a vacation, a rainy day fund, or anything else—and you can open multiple accounts to stay organized.

- Personalize Your Accounts: By nicknameing your accounts, you’ll have an easier time tracking your progress. Name your accounts based on your specific goals, like “Hawaii Trip” or “Wedding Fund.”

- Flexible Contributions: Add funds at your own pace. There’s no minimum balance requirement, so you can start small and build your savings over time.

-

Open a Member's Choice Savings Account

Start saving for your big idea. Open an account online.

-

Open an Account in Person

Visit one of our five branches in Southeast Michigan.

-

View Member Benefits

Check out all the benefits of being a member at PDCU.

-

Speak with an Expert

Have questions about opening a Member's Choice Savings Account?

Why Choose a Member’s Choice Savings Account?

- Tailored to You: Unlike traditional savings accounts, Member’s Choice lets you open and manage multiple accounts to match your unique goals. It’s designed to help you focus on specific financial objectives.

- Stay Organized: Nicknaming accounts makes it easy to track how close you are to achieving each goal. Whether you’re saving for one thing or many, everything is in one convenient place.

Features:

- No Minimum Deposit: Start saving with as little or as much as you like. No minimum deposit is required, making it simple to begin saving immediately.

- No Fees: Keep your savings intact with no monthly service fees.

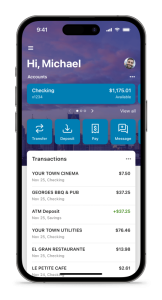

- Track and Manage: Stay on top of your savings with 24/7 online and mobile banking access.

Perfect for Any Savings Goal:

- Vacations: Save for that dream getaway by setting aside funds regularly.

- Major Purchases: Whether it’s a new car, home renovation, or special event, a Member’s Choice Savings Account makes it easier to plan for big expenses.

- Education: Start putting money aside for college, classes, or certifications—your future self will thank you.

Ready to Take Control of Your Savings?

Open a Member’s Choice Savings Account today and start saving for what matters most to you. Create personalized accounts for your goals and watch your savings grow over time.

Account Details:

- Minimum Deposit: $0.00

- Account Access: Online and mobile banking, in-branch deposits

- Personalized Account Nicknames: Customizable for easy tracking

Open a Member’s Choice Savings Account

Contact Us

Need assistance or have questions?

Visit your nearest branch or contact us for more information.

Frequently Asked Questions

The difference between the Dividend Rate and APY (Annual Percentage Yield) lies primarily in considering compounding. Here’s a breakdown:

Interest Rate

- Definition: The interest rate is the nominal rate at which interest is paid on the principal amount.

- Compounding: It does not account for how often interest is compounded. It is simply the rate without considering the effects of compounding within the period.

- Usage: Often quoted as an annual rate, but it can be applied over different compounding periods (monthly, quarterly, etc.).

Dividend Rate

- Definition: Similar to the interest rate, but typically used by credit unions or certain investment accounts to describe the rate paid on deposits or investments.

- Compounding: Like the interest rate, it does not account for the compounding frequency.

APY (Annual Percentage Yield)

- Definition: APY reflects the total amount of interest earned on an account in a year, accounting for the effect of compounding interest.

- Compounding: It includes the effects of compounding interest. Which means it shows the real return on investment or savings over a year.

- Formula: The formula for APY is:

APY = (1 + r/n)^n - 1

Where r is the nominal interest rate, and n is the number of compounding periods per year.

Dividend Rate vs APY Example

Interest Rate/Dividend Rate: If a savings account offers a 5% interest rate compounded monthly, the nominal rate is 5%. APY: When considering the monthly compounding, the same account will have an APY slightly higher than 5% because the interest earned each month also earns interest in subsequent months.Key Differences

- Compounding Effect: APY incorporates the effect of compounding, whereas the nominal interest/dividend rate does not.

- True Earnings: APY provides a clearer picture of the actual annual earnings from an account or investment.

- Comparison: APY is a better metric for comparing different financial products as it standardizes the impact of compounding across different offers.

In summary, while the interest rate or dividend rate gives you an idea of the annual rate of return without compounding, the APY gives you the actual yearly return, considering the compounding of interest.

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select "Deposits."

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone's frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we're here to make your financial management effortless.

To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on "Deposit." Enter the check amount, click "Continue," and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write "For Mobile Deposit Only at PDCU", and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it "VOID" and shredding it.

Disclosures

People Driven Credit Union Savings Accounts are Federally insured to at least $250,000 by the NCUA and backed by the full faith and credit of the United States Government. APR = Annual Percentage Rate. Rates effective as of today and may change at any time. View our Privacy Policy and read our disclaimer regarding links to other sites.