Holiday Loans for Seasonal Expenses

The holiday season can put a strain on your budget with gift shopping, festive gatherings, and travel costs. People Driven Credit Union (PDCU) is here to help with our PD Quick Cash Holiday Loan Special and our PDCU Holiday Loan Special, designed to ease your financial burden and help you manage these seasonal expenses.

Our PD Quick Cash Holiday Loan also allows you to consolidate higher-interest debts incurred throughout the year, making your financial situation more manageable as the holidays approach.

|

For current members in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

For nonmembers or members without a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

PD Quick Cash Holiday Loan Special

– Up to $2,000 –

For current members in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months. Loan amount determined by the total average of the member’s aggregate monthly deposits.

$2,000 Loan Terms:

For a PD Quick Cash Holiday Loan of $2,000 paid off over 11 months:

| Amount Financed: | $2,000.00 |

| Processing Fee: | $15.00 |

| Payment Guard Insurance: | Free |

| APR: | 9.99% APR* |

| Payment Every Month: | $191.01 |

| Total # of Payments: | 11 |

| Total Interest: | $86.11 |

| Total of Payments: | $2,101.11 |

PDCU Holiday Loan Special

– Up to $2,000 –

For nonmembers or members without a minimum direct deposit of $1,000 monthly for at least six consecutive months. APR and loan term is subject to approval and may be determined upon the borrower’s creditworthiness, the amount borrowed.

$2,000 Loan Terms:

For a PDCU Holiday Loan of $2,000 paid off over 11 months:

| Amount Financed: | $2,000.00 |

| Processing Fee: | $0.00 |

| Payment Guard Insurance: | N/A |

| APR: | 10.84%¹ APR* |

| Payment Every Month: | $191.82 |

| Total # of Payments: | 11 |

| Total Interest: | $110.02 |

| Total of Payments: | $2,110.02 |

PD Quick Cash Holiday Loan Key Features:

- Maximum Annual Percentage Rate (APR): 9.99% Benefit from a low fixed APR for the term of the loan.

- 11-Month Term: Manageable repayment period to suit your financial planning.

- Origination Fee: $15

PD Quick Cash Holiday Loan Eligibility:

- Be a member of People Driven Credit Union for at least three months

- Have direct deposit set up

- Loan amount determined by member’s deposits

A PD Quick Cash Holiday Loan can be used for:

- Gift Shopping

- Decorations

- Festive Gatherings

- Travel Costs

- Anything You Need to Make Your Holiday Special

How to Apply for a PD Quick Cash Holiday Loan:

- Check Your Eligibility: Ensure you have direct deposit set up and have been a member for at least three months.

- Apply Online, on the MyPDCU app, or In-Branch: You can apply for the Holiday Loan online or by stopping by any of our branches.

- Get Approved Quickly: Our streamlined approval process promptly ensures you get the funds you need.

TruStage™ Payment Guard Insurance

With a PD Quick Cash Holiday Loan from People Driven Credit Union, you don’t just get fast access to funds—you also get free loan insurance! Our PD Quick Cash Holiday Loans now come with TruStage™ Payment Guard Loan Insurance, automatically included at no additional cost to you.

In the event of a covered job loss, TruStage™ Payment Guard Insurance provides a lump sum payment of $500 toward your loan balance, helping to ease your financial burden during challenging times. Stay protected and secure your financial future with a PD Quick Cash Holiday Loan and TruStage™ Payment Guard Insurance.

PD Quick Cash Holiday Loan Special

– Up to $2,000 –

For current members in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months. Loan amount determined by the total average of the member’s aggregate monthly deposits.

$2,000 Loan Terms:

For a Holiday Loan of $2,000 paid off over 11 months:

| Amount Financed: | $2,000.00 |

| Processing Fee: | $15.00 |

| Payment Guard Insurance: | Free |

| APR: | 9.99% APR* |

| Payment Every Month: | $191.01 |

| Total # of Payments: | 11 |

| Total Interest: | $86.11 |

| Total of Payments: | $2,101.11 |

Frequently Asked Questions

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the Holiday Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

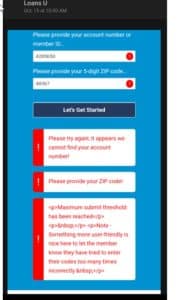

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

The origination fee varies depending on the loan amount requested:

- Loan Amount $500-$999: Origination Fee $12

- Loan Amount $1000-$1500: Origination Fee $25

- Loan Amount $1501-$2000: Origination Fee $35

Disclosures

PD Quick Cash Holiday Loan Special Qualifications

*APR = Annual Percentage Rate. The PD Quick Cash Holiday Loan Special runs from October 15th through December 31st, 2024, with an Annual Percentage Rate (APR) of 9.99%. Members in good standing who receive monthly direct deposits can borrow up to $2,000 (loan amount determined by the total average of the member’s aggregate monthly deposits), with one loan allowed per Social Security number. For a $2,000 loan, the monthly payment is $191.01, and for a $1,00 loan, the payment is $95.51.

New and current members who do not meet the direct deposit criteria are welcome to apply for a regular personal loan. There is no prepayment penalty for this loan. To qualify, borrowers must be the primary account holder, in good standing with PDCU, have a valid email and physical address, and be current on all PDCU accounts for the last 90 days. Applicants must be at least 18 years old, and joint, business, trustee, conservatorship, and minor accounts are not eligible for this loan. The actual APR and loan term is subject to approval and may be determined upon the borrower’s creditworthiness and the amount borrowed. Rates are effective as of today and are subject to change.

¹Special Loan Rate Discount: Benefit from a .25% reduction when enrolling in our autopay service, which is included in the “as low as” rate advertised. The discount is available to those who setup autopay of their monthly loan payment from a People Driven Credit Union checking or savings account.