-

Overview

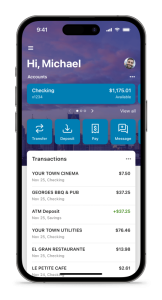

Add a Checking Account that gives you easy access to your money for all of your daily transaction needs. Check out all the great features that our PDCU Checking Account has to offer including Debit Card, Bill Pay and Mobile Deposit!

People Driven Credit Union Checking Account Benefits:

Control

Make purchases without increasing debt, track and control spending to stay on top of account activity.

- Debit transactions are deducted directly from a checking account with no interest charges

- Transaction history available on mobile app or online banking

- Personalized transaction notifications via text or email

- Travel notifications made in the app

Convenience

Whether you’re shopping online, over the phone, or at the stores, use your checking account debit card everywhere VISA® Cards are accepted.

- No minimum purchase amount

- Accepted at millions of merchants worldwide

- Compatible with Apple Pay®, Samsung Pay®, and Google Pay™

- Skip the ATM, get cash back at the register

Security

Shop worry-free and confidently with our security precautions.

- Chip Technology encrypts your transactions to safeguard account information

- Freeze/Unfreeze service keeps others from using your card if lost

- Safer than cash or checks

Get Paid Early

Direct deposit is the fastest way to access your money.

- Employment paychecks

- Social Security

- Pension Payments

You Might Also Be Interested In...

-

Account Options

With competitive rates, low fees, and personalized service, opening an account with PDCU is the first step toward achieving your financial dreams.

-

Savings Accounts

Your $5 deposit gives you a share in the credit union and allows you to use all of the great services.

-

No Hidden Fees

The Fee Schedule sets forth certain conditions, fees, and charges applicable to all People Driven Credit Union accounts.

-

FAQs

Frequently Asked Questions

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select "Deposits."

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone's frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we're here to make your financial management effortless.

For wiring funds to a People Driven Credit Union account:

Wire to:- Alloya Corporate Federal Credit Union 26555 Evergreen Southfield, MI 48076 ABA number: 2724-78075

- People Driven Credit Union 24333 Lahser Southfield, MI 48033 Account Number: 2724-84988

- Member’s PDCU Account Number Member’s Address Account member wants funds deposited into (for example, Savings or Checking)

PDCU's checking accounts do not require a minimum balance and have no monthly maintenance fees!To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on "Deposit." Enter the check amount, click "Continue," and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write "For Mobile Deposit Only at PDCU", and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it "VOID" and shredding it.

To minimize the risk of overdrafts, we recommend checking your account balance daily. Pay transactions only when sufficient funds are available, and avoid assuming that all items will clear your account immediately. Additionally, consider utilizing e-alerts to receive notifications when your balance is running low. For more information, please refer to the E-Alerts section.Please log into the online banking site. Under the e-statements tab you will see ‘order checks’. Please click that and you will be directed to Harland Clarke to compete your order. Prices vary by style.PDCU offers a few types of checking accounts, view all our Checking Account Options.