9-month CD

Withdrawing money from a 9-month CD before the term ends typically incurs an early withdrawal penalty. At People Driven Credit Union, the Early Withdrawl Penalty is a Loss of 90 days of interest for withdrawing funds early.

Yes, your money is safe in a 9-month CD. At People Driven Credit Union, our CDs are insured by the NCUA (National Credit Union Administration) up to $250,000 per depositor.

The difference between the Dividend Rate and APY (Annual Percentage Yield) lies primarily in considering compounding. Here’s a breakdown:

Interest Rate

- Definition: The interest rate is the nominal rate at which interest is paid on the principal amount.

- Compounding: It does not account for how often interest is compounded. It is simply the rate without considering the effects of compounding within the period.

- Usage: Often quoted as an annual rate, but it can be applied over different compounding periods (monthly, quarterly, etc.).

Dividend Rate

- Definition: Similar to the interest rate, but typically used by credit unions or certain investment accounts to describe the rate paid on deposits or investments.

- Compounding: Like the interest rate, it does not account for the compounding frequency.

APY (Annual Percentage Yield)

- Definition: APY reflects the total amount of interest earned on an account in a year, accounting for the effect of compounding interest.

- Compounding: It includes the effects of compounding interest. Which means it shows the real return on investment or savings over a year.

- Formula: The formula for APY is:

APY = (1 + r/n)^n - 1

Where r is the nominal interest rate, and n is the number of compounding periods per year.

Dividend Rate vs APY Example

Interest Rate/Dividend Rate: If a savings account offers a 5% interest rate compounded monthly, the nominal rate is 5%.

APY: When considering the monthly compounding, the same account will have an APY slightly higher than 5% because the interest earned each month also earns interest in subsequent months.

Key Differences

- Compounding Effect: APY incorporates the effect of compounding, whereas the nominal interest/dividend rate does not.

- True Earnings: APY provides a clearer picture of the actual annual earnings from an account or investment.

- Comparison: APY is a better metric for comparing different financial products as it standardizes the impact of compounding across different offers.

In summary, while the interest rate or dividend rate gives you an idea of the annual rate of return without compounding, the APY gives you the actual yearly return, considering the compounding of interest.

APY stands for Annual Percentage Yield. It is a measure of the total amount of interest earned on an account based on the interest rate and the frequency of compounding over a year. APY is a useful metric for comparing the annual earnings on different savings products, such as savings accounts, CDs, and money market accounts, because it standardizes the effect of compounding.

Key Points About APY

- Includes Compounding: APY accounts for how often interest is compounded (e.g., daily, monthly, quarterly), which can significantly affect the total interest earned over time.

- Comparison Tool: APY provides a standard way to compare the annual interest earnings of different savings products, regardless of how frequently interest is compounded.

- Formula: The formula for calculating APY is:

APY = (1 + r/n)^n - 1

where r is the nominal interest rate (expressed as a decimal), and n is the number of compounding periods per year.

- Higher APY: A higher APY indicates that you will earn more interest on your money over a year, assuming the same principal amount.

Example

For example, if a savings account offers an interest rate of 5% compounded monthly, the APY would be higher than 5% due to the effect of monthly compounding. This makes APY a useful metric for comparing the real return on different financial products.

A 9-month CD works as follows:

- Opening the CD: You deposit a lump sum of money into the CD account. The amount often needs to meet the bank or credit union’s minimum deposit requirement.

- Fixed Term: The money is committed to the CD for a fixed term of nine months. During this period, you cannot add to or withdraw from the principal amount without incurring penalties.

- Interest Rate: The bank or credit union pays you a fixed interest rate on the deposited amount for the entire term. This rate is usually higher than that of a regular savings account because the bank can use your money for a predictable period.

- Interest Accumulation: Interest is typically compounded and credited to your account at regular intervals, such as monthly or quarterly.

- Maturity: At the end of the 9-month term, the CD matures. You then have a few options:

- Withdraw the funds: You can take out your initial deposit plus the interest earned.

- Renew the CD: You can roll over the funds into a new CD, either for the same term or a different one, possibly at a new interest rate.

- Transfer the funds: You can transfer the money to another account.

- Early Withdrawal Penalty: If you need to access the money before the 9-month term ends, you will likely face an early withdrawal penalty. This penalty varies by institution but generally involves forfeiting a portion of the interest earned.

- FDIC/NCUA Insurance: If the CD is held at a bank, it is insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor per bank. If held at a credit union, it is insured by the NCUA (National Credit Union Administration) with the same coverage limits.

A 9-month CD can be a suitable option for short-term savings goals, offering a balance between earning a higher interest rate and having your money tied up for a relatively short period.

A 9-month CD (Certificate of Deposit) is a type of savings account offered by banks and credit unions. Here are the key characteristics:

- Fixed Term: It has a maturity period of nine months, during which the deposited money is locked in.

- Interest Rate: Typically offers a fixed interest rate generally higher than regular savings accounts.

- Minimum Deposit: Often requires a minimum deposit amount to open the account.

- Early Withdrawal Penalty: If you withdraw the funds before the 9-month term ends, you usually incur a penalty, a portion of the interest earned, or a specified fee.

- FDIC Insured: In the United States, CDs from credit unions are usually insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor per credit union.

A 9-month CD can be a good option if you have a specific short-term savings goal and want to earn a higher interest rate without taking on much risk.

Accounts

The difference between the Dividend Rate and APY (Annual Percentage Yield) lies primarily in considering compounding. Here’s a breakdown:

Interest Rate

- Definition: The interest rate is the nominal rate at which interest is paid on the principal amount.

- Compounding: It does not account for how often interest is compounded. It is simply the rate without considering the effects of compounding within the period.

- Usage: Often quoted as an annual rate, but it can be applied over different compounding periods (monthly, quarterly, etc.).

Dividend Rate

- Definition: Similar to the interest rate, but typically used by credit unions or certain investment accounts to describe the rate paid on deposits or investments.

- Compounding: Like the interest rate, it does not account for the compounding frequency.

APY (Annual Percentage Yield)

- Definition: APY reflects the total amount of interest earned on an account in a year, accounting for the effect of compounding interest.

- Compounding: It includes the effects of compounding interest. Which means it shows the real return on investment or savings over a year.

- Formula: The formula for APY is:

APY = (1 + r/n)^n - 1

Where r is the nominal interest rate, and n is the number of compounding periods per year.

Dividend Rate vs APY Example

Interest Rate/Dividend Rate: If a savings account offers a 5% interest rate compounded monthly, the nominal rate is 5%.

APY: When considering the monthly compounding, the same account will have an APY slightly higher than 5% because the interest earned each month also earns interest in subsequent months.

Key Differences

- Compounding Effect: APY incorporates the effect of compounding, whereas the nominal interest/dividend rate does not.

- True Earnings: APY provides a clearer picture of the actual annual earnings from an account or investment.

- Comparison: APY is a better metric for comparing different financial products as it standardizes the impact of compounding across different offers.

In summary, while the interest rate or dividend rate gives you an idea of the annual rate of return without compounding, the APY gives you the actual yearly return, considering the compounding of interest.

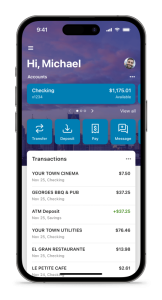

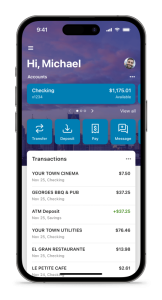

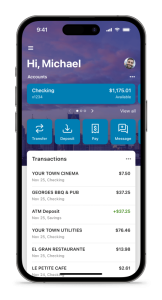

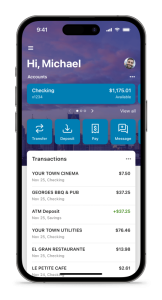

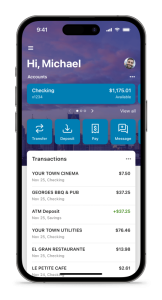

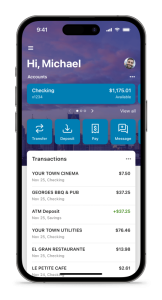

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select “Deposits.”

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone’s frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we’re here to make your financial management effortless.

Please give us a call at 248-263-4100 or toll free at 844-700-7328 and speak with a representative to assist you.

iTalk Telephone Teller is a free telephone banking service. Check your account balances, see if a check has cleared, transfer money between accounts, check your loan balance, make loan payments from checking or savings, or request a statement be mailed to you, etc. Please dial us toll-free at 844-700-7328 or call us at 248-263-4100 and choose option 1.

To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on “Deposit.” Enter the check amount, click “Continue,” and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write “For Mobile Deposit Only at PDCU”, and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it “VOID” and shredding it.

YES! Depending on your browser, once you have opened your statement you may see icons on the top corner for downloading and printing. You may also right click on your mouse and choose ‘save as’ or ‘print’.

We suggest using a password only you would know. Do not save any passwords on devices that are not yours. Use facial recognition or thumbprint recognition on your private devices.

When preparing your tax return, you are asked to include the amounts of interest earned on your accounts. If your account earned $10 or more in the calendar year, a 1099-INT will be issued. 1099-INTs are typically mailed to you by the end of January in the new year. You can also access this in online banking; click the E-statement tab and choose ‘Tax statements.’

There is a $1 per month charge for mailed statements unless you are under 23 years of age or are a Senior Power Pack member.

PDCU has partnered with GreenPath Financial Wellness to help our members get back on track with their finances and credit. Please call GreenPath at 877-337-3399 and let them know you’re a PDCU member and would like to make an appointment with a rep!

Adjustable Rate Mortgage

Yes, many borrowers choose to refinance their ARM to a fixed-rate mortgage before the adjustable period begins to lock in a stable interest rate and predictable monthly payments.

Consider your financial situation, how long you plan to stay in the home, and your risk tolerance for potential interest rate changes. ARMs can be a good choice if you plan to sell or refinance before the adjustable period begins or expect interest rates to remain stable or decline.

Some ARMs may have prepayment penalties, but People Driven Credit Union does not. You can refinance or pay off your Adjustable Rate Mortgage with PDCU early without any prepayment penalties.

Yes, ARMs often have caps that limit how much the interest rate can increase at each adjustment period and over the life of the loan. These caps provide some protection against large payment increases.

ARM interest rates adjust based on a specific index (such as the Treasury index) plus a margin set by the lender. When the index rate changes, the interest rate on your loan adjusts accordingly.

The main risk with an ARM loan is that your monthly payments can increase if interest rates rise. Understanding the potential for payment changes is important to ensure that you can afford higher payments if the rate adjusts upward.

ARMs typically offer lower initial interest rates compared to fixed-rate mortgages, which can lead to lower initial monthly payments. This can be beneficial if you plan to sell or refinance before the adjustable period begins.

The initial period is when the interest rate on an ARM is fixed. After this period, the rate adjusts at regular intervals. For example, a 7/1 ARM has a fixed rate for the first seven years and then adjusts once every 12 months.

ARMs are often described with two numbers, such as 5/5, 7/1, or 10/1. The first number indicates the initial fixed-rate period (in years), and the second number indicates how often the rate will adjust after the initial period (in years).

Unlike a fixed-rate mortgage, where the interest rate remains constant throughout the loan term, an Adjustable Rate Mortgage has an interest rate that adjusts periodically. This means your monthly payments can increase or decrease over time based on changes in the interest rate.

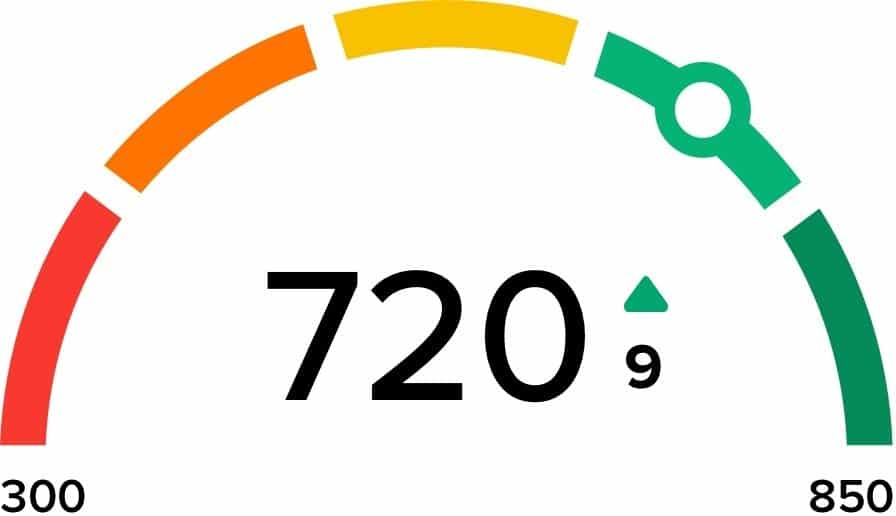

Auto Loans

Your credit score plays a big role in determining your loan’s interest rate and terms. Borrowers with higher credit scores typically qualify for lower interest rates, while those with lower credit scores may face higher rates.

- New auto loans apply to brand-new cars, trucks, vans, and vehicles five years old or newer. They often have lower interest rates because new cars typically have better collateral value.

- Used auto loans apply to pre-owned vehicles older than five years; interest rates may be slightly higher since used cars have less value over time.

An auto loan is a type of financing that allows you to borrow money to purchase a vehicle. The loan is secured by the vehicle itself, meaning the lender can repossess the vehicle if you fail to repay the loan.

Missing a payment can result in late fees and negatively affect your credit score. Repeated missed payments may lead to vehicle repossession. It’s important to contact People Driven Credit Union as soon as possible if you anticipate any issues making payments on your loan from PDCU.

A down payment isn’t always required, but it’s generally a smart move. Putting money down reduces the amount you’ll need to borrow, which can lower your monthly payments and reduce the total interest paid over the life of the loan. At People Driven Credit Union, we offer 100% financing for new cars (5 years old or newer). For used cars (older than 5 years), we’ll finance up to 80% of the vehicle’s value (LTV).

- Auto loans: These are for purchasing a new or used vehicle.

- Auto refinancing: You can replace your current auto loan with a new one, typically to get a lower interest rate or change the loan term.

Term lengths for auto loans from People Driven Credit Union range from 12 months (1 year) to 96 months (9 years). The longer the term, the lower your monthly payments, but you may pay more in interest over the life of the loan.

To apply for an auto loan with People Driven Credit Union, you will need:

- A valid ID

- Proof of income (like pay stubs or tax returns)

- Employment information

- Vehicle details (if you’ve already chosen one – the VIN #)

- Proof of insurance

Yes, People Driven Credit Union offers pre-approval for auto loans. Pre-approval helps you understand how much you can afford and can give you leverage when negotiating with dealers.

People Driven Credit Union members can pay off an auto loan anytime with no penalty.

CD

An Educational IRA Certificate, more commonly known as a Coverdell Education Savings Account (ESA) Certificate, is a savings product designed to help families save for educational expenses. This type of account combines the benefits of a Certificate of Deposit (CD) with the tax advantages of a Coverdell ESA. Here’s a detailed explanation of its key aspects:

Key Features:

- Tax Advantages:

- Contributions grow tax-deferred, and withdrawals are tax-free when used for qualified educational expenses.

- Fixed Interest Rate:

- Like a traditional CD, an Educational IRA Certificate offers a fixed interest rate, providing a predictable return on your investment over a specified term.

- Term Options:

- These certificates typically come with various term lengths, allowing you to choose one that matches your timeline for when the funds will be needed for educational expenses.

- Contribution Limits:

- The annual contribution limit for a Coverdell ESA is $2,000 per beneficiary. Contributions must be made with after-tax dollars, but the earnings grow tax-deferred.

- Age Limits:

- Contributions can be made until the beneficiary reaches age 18. The account must be used for educational expenses by the time the beneficiary reaches age 30.

- Qualified Expenses:

- Funds can be used for a wide range of educational expenses, including tuition, fees, books, supplies, equipment, and in some cases, room and board for students enrolled at least half-time.

- Transferability:

- If the designated beneficiary does not need the funds, the account can be transferred to another eligible family member without penalty.

Benefits of a Educational IRA Certificate:

- Tax-Free Withdrawals: When used for qualified educational expenses, withdrawals are tax-free, providing significant savings.

- Predictable Returns: Fixed interest rates offer stability and predictability for your savings.

- Wide Range of Uses: Funds can be used for a variety of educational expenses, covering primary, secondary, and higher education.

Considerations:

- Contribution Limits: The annual contribution limit is relatively low, which might not cover all educational expenses but can significantly help.

- Age Restrictions: Contributions must stop when the beneficiary turns 18. Funds must be used by age 30, or they will incur taxes and penalties.

- Early Withdrawal Penalties: If funds are not used for qualified educational expenses, withdrawals will be subject to taxes and penalties on the earnings.

Educational IRA Certificates are Suitable For:

- Parents and Guardians: Those looking to save for their child’s educational expenses in a tax-advantaged way.

- Family Members: Relatives who want to contribute to a child’s education savings.

- Long-Term Planners: Investors who prefer the stability and predictability of a fixed interest rate over time.

An Educational IRA Certificate is an excellent tool for families planning for future educational expenses. It combines the security and predictability of a traditional CD with the tax advantages of a Coverdell ESA, making it a valuable addition to your education savings strategy.

A Money Market IRA Certificate is a retirement savings product that combines the features of a money market account with those of a Certificate of Deposit (CD), all within the structure of an Individual Retirement Account (IRA). Here’s a detailed explanation of its key aspects:

Key Features:

- Higher Interest Rates:

- Higher interest rates compared to regular savings accounts. The rates are typically variable, meaning they can change based on market conditions.

- Tax Advantages:

- Contributions grow tax-deferred. If the account is a Traditional IRA, contributions may be tax-deductible. For Roth IRAs, contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

- Flexible Terms:

- These certificates may offer various term lengths, giving you the flexibility to choose a term that aligns with your retirement planning.

- Liquidity and Access:

- Money Market IRA Certificates often provide more liquidity than traditional CDs. You might be allowed to make a limited number of withdrawals or transfers without incurring penalties, although this can vary by institution.

- Stable Investment:

- They are generally considered low-risk investments, providing stability and security for your retirement funds. The principal is typically protected, and you earn a steady return.

- Contribution Limits:

- The annual contribution limits for Money Market IRA Certificates are the same as for other IRAs, set by the IRS.

- Insurance:

- Money Market IRA Certificates are usually insured by the FDIC (for banks) or the NCUA (for credit unions) up to applicable limits, providing an extra layer of security.

Benefits of a Money Market IRA Certificate:

- Tax-Deferred Growth: Your earnings grow tax-deferred in a Traditional IRA or potentially tax-free in a Roth IRA.

- Higher Returns: Often offer higher returns than regular savings accounts while still maintaining a low level of risk.

- Flexibility: Typically more flexible than traditional CDs, with some allowing limited withdrawals.

- Security: FDIC or NCUA insurance provides peace of mind that your investment is protected.

Considerations:

- Variable Rates: Interest rates can fluctuate based on market conditions, which might affect the growth of your savings.

- Contribution Limits: Be mindful of the annual contribution limits set by the IRS.

- Early Withdrawal Penalties: Similar to other IRAs, early withdrawals before age 59½ may incur penalties and taxes, except for qualified exceptions.

Money Market IRA Certificates Are Suitable For:

- Conservative Investors: Those looking for a stable and low-risk investment for their retirement savings.

- Retirement Savers: Individuals who want the benefits of a money market account combined with the tax advantages of an IRA.

- Those Needing Flexibility: Investors who prefer the potential for higher returns with some access to their funds.

A Money Market IRA Certificate is an excellent option for individuals seeking a balance between earning a higher return on their retirement savings and maintaining a low-risk investment. It offers the benefits of tax-deferred growth, competitive interest rates, and the security of a money market account, all within the framework of an IRA.

A Traditional IRA Certificate is a type of savings product offered by financial institutions that combines the benefits of a traditional Individual Retirement Account (IRA) with the features of a Certificate of Deposit (CD). Here’s a breakdown of its key aspects:

Key Features of a Traditional IRA Certificate:

- Tax-Deferred Growth:

- Contributions to a Traditional IRA are often tax-deductible, meaning you can reduce your taxable income in the year you make the contribution.

- The money in the account grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw the money during retirement.

- Fixed Interest Rate:

- Traditional IRA Certificates typically offer a fixed interest rate for a specified term, providing predictable returns.

- Terms and Maturity:

- These certificates usually have specific terms ranging from a few months to several years.

- At the end of the term, known as the maturity date, you can either withdraw the funds, renew the certificate, or roll it over into another IRA.

- Early Withdrawal Penalties:

- Withdrawing funds before the certificate matures may incur penalties.

- Additionally, withdrawals before age 59½ are generally subject to a 10% early withdrawal penalty on top of regular income taxes, though there are exceptions for certain circumstances.

- Contribution Limits:

- The annual contribution limits are the same as for IRAs, set by the IRS.

- Required Minimum Distributions (RMDs):

- Starting at age 73 (as of 2023), you must begin taking required minimum distributions from your Traditional IRA, which includes funds in IRA Certificates.

Benefits:

- Secure and Predictable: Since Traditional IRA Certificates offer fixed rates, they provide a secure and predictable way to grow retirement savings.

- Tax Advantages: Contributions may be tax-deductible, and the earnings grow tax-deferred.

- Retirement Savings: This is an effective tool for long-term retirement savings, offering a steady growth path.

Considerations:

- Penalties for Early Withdrawal: Be mindful of the penalties associated with early withdrawal both from the certificate and from the IRA.

- Contribution Limits: Stay within the annual contribution limits set by the IRS.

- RMDs: Plan for required minimum distributions starting at age 73.

Traditional IRA Certificates are a good choice for conservative investors looking to grow their retirement savings with minimal risk and tax advantages.

A Roth IRA Certificate, also known as a Roth IRA CD (Certificate of Deposit), is a type of investment that combines the benefits of a Roth Individual Retirement Account (IRA) with the fixed interest rates and security of a Certificate of Deposit (CD).

Here’s a breakdown of the features of a a Roth IRA Certificate:

- Tax Advantages: Contributions to a Roth IRA are made with after-tax dollars, meaning you won’t get a tax deduction. However, the money grows tax-free, and qualified withdrawals in retirement are also tax-free.

- Fixed Interest Rates: Like a regular CD, a Roth IRA CD offers a fixed interest rate for a specified term, providing predictable growth for your investment.

- Security: Insured financial institutions widely recognize Roth IRA CDs as secure investments. They safeguard your principal and assure you of a specific return on your investment.

- Flexible Terms: Roth IRA CDs come with various term lengths, typically ranging from a few months to several years. Longer terms usually offer higher interest rates.

- Contribution Limits: Contributions to a Roth IRA CD count toward your annual Roth IRA contribution limit, which the IRS sets. For 2024, the limit is $7,000, or $8,000 if you are 50 or older.

- Withdrawal Rules: You can withdraw contributions from a Roth IRA without penalty. However, you may incur taxes and penalties if you withdraw earnings before age 59½ and before the account has been open for at least five years.

- Early Withdrawal Penalties: If you withdraw your money from the CD before the term ends, you may incur early withdrawal penalties, similar to a regular CD.

- Retirement Focused: Unlike regular CDs, which are often used for short—to medium-term savings goals, Roth IRA CDs are specifically designed for retirement savings. They provide the advantages of a Roth IRA with the reliability of a CD.

Overall, a Roth IRA Certificate is an excellent choice for those looking to grow their retirement savings with the security of a fixed-income investment and the tax advantages of a Roth IRA.

A Certificate of Deposit is a secure and reliable savings tool that offers higher interest rates in exchange for committing your funds for a fixed period. It’s an excellent option for those looking to achieve specific financial goals with minimal risk.

Key Features of a Certificate of Deposit (CD):

- Fixed Term: CDs have a specified term or maturity date, which can range from a few months to several years. Common terms are 6 months, 1 year, 2 years, or 5 years.

- Interest Rate: CDs typically offer a higher interest rate than regular savings accounts. The rate is fixed for the duration of the term, providing a predictable return on investment.

- Minimum Deposit: Many CDs require a minimum deposit to open, which can vary depending on the financial institution and the specific CD product.

- Early Withdrawal Penalties: Withdrawing funds from a CD before it matures usually incurs a penalty, which can reduce or negate the interest earned. Some CDs offer more flexible terms with lower penalties or no penalties for early withdrawal, but these often come with lower interest rates.

- FDIC/NCUA Insurance: CDs from banks are typically insured by the Federal Deposit Insurance Corporation (FDIC), and CDs from credit unions are insured by the National Credit Union Administration (NCUA), up to the maximum limit allowed by law.

A CD (Certificate of Deposit) Ladder is an investment strategy that involves dividing a sum of money into multiple CDs with different maturity dates. The primary goal of this approach is to balance the benefits of earning higher interest rates on longer-term CDs while maintaining liquidity by having funds become available periodically. Here’s how it works:

How a CD Ladder Works

- Divide Your Investment:

- You start by dividing your total investment into equal parts. For example, if you have $10,000, you might divide it into five parts of $2,000 each.

- Purchase CDs with Staggered Maturities:

- Invest each portion in CDs with different maturities. For instance, you could buy a 1-year CD, a 2-year CD, a 3-year CD, a 4-year CD, and a 5-year CD.

- Reinvest as CDs Mature:

- As each CD matures, you reinvest the principal (and interest, if desired) into a new CD with the longest term in your ladder. For example, when the 1-year CD matures, you would reinvest that amount into a new 5-year CD and continue this process as each CD matures.

Benefits of a CD Ladder

- Higher Interest Rates:

- Longer-term CDs typically offer higher interest rates compared to short-term CDs. By using a ladder strategy, you can take advantage of these higher rates for at least a portion of your investment.

- Regular Access to Funds:

- A portion of your investment will mature at regular intervals (e.g., every year), giving you periodic access to your money without penalty. This can be useful for meeting short-term financial needs or taking advantage of new investment opportunities.

- Reduced Interest Rate Risk:

- By spreading your investment across CDs with varying maturities, you reduce the risk of being locked into a low-interest rate for an extended period if rates rise. As each CD matures, you can reinvest at the current rates, potentially benefiting from higher interest rates.

- Predictable Returns:

- CDs are generally considered low-risk investments with fixed interest rates, providing predictable returns. This makes a CD ladder a stable and reliable investment strategy.

Example of a CD Ladder

Let’s say you have $10,000 to invest and you set up a 5-year CD ladder:

- Year 1:

- Invest $2,000 in a 1-year CD

- Invest $2,000 in a 2-year CD

- Invest $2,000 in a 3-year CD

- Invest $2,000 in a 4-year CD

- Invest $2,000 in a 5-year CD

- Year 2:

- The 1-year CD matures. Reinvest the $2,000 in a new 5-year CD.

- The other CDs continue to mature according to their original terms.

- Year 3:

- The 2-year CD matures. Reinvest the $2,000 in a new 5-year CD.

- The other CDs continue to mature.

- Year 4:

- The 3-year CD matures. Reinvest the $2,000 in a new 5-year CD.

- The other CDs continue to mature.

- Year 5:

- The 4-year CD matures. Reinvest the $2,000 in a new 5-year CD.

- The 5-year CD continues to mature.

By the end of Year 5, you have a ladder of 5-year CDs maturing every year, providing you with a regular income stream and the opportunity to reinvest at current interest rates.

A CD Ladder is an effective strategy to maximize returns while maintaining liquidity and reducing interest rate risk. It’s an excellent choice for conservative investors looking for a predictable and stable way to grow their savings. At People Driven Credit Union, we offer competitive rates and flexible terms to help you build a CD ladder that meets your financial goals. Contact us today to learn more about how you can get started with a CD Ladder and take control of your financial future.

You will receive a notice in the mail 30 days before the maturity date of your CD.

Once the initial deposit has been made funds cannot be added to the CD until maturity. Once the CD matures you may add funds if you wish to renew the CD.

Yes. The penalty for withdrawing from/closing the CD will be based on the interest earned on the account.

Although a CD is not necessarily liquid, it is considered one of the safest investments available. The longer CD you have, the higher the rate is going to be. There are no fees for the Certificate of Deposit, and you earn interest based on the balance in the CD.

Checking

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select “Deposits.”

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone’s frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we’re here to make your financial management effortless.

For wires with People Driven Credit Union, use this form and the information below:

Wire to:

- Alloya Corporate Federal Credit Union

26555 Evergreen

Southfield, MI 48076

ABA number: 2724-78075

Credit:

- People Driven Credit Union

24333 Lahser

Southfield, MI 48033

Account Number: 2724-84988

Final Credit Member Name:

- Member’s PDCU Account Number

Member’s Address

Account member wants funds deposited into (for example, Savings or Checking)

PDCU’s checking accounts do not require a minimum balance and have no monthly maintenance fees!

To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on “Deposit.” Enter the check amount, click “Continue,” and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write “For Mobile Deposit Only at PDCU”, and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it “VOID” and shredding it.

To minimize the risk of overdrafts, we recommend checking your account balance daily. Pay transactions only when sufficient funds are available, and avoid assuming that all items will clear your account immediately. Additionally, consider utilizing e-alerts to receive notifications when your balance is running low. For more information, please refer to the E-Alerts section.

Please log into the online banking site. Under the e-statements tab you will see ‘order checks’. Please click that and you will be directed to Harland Clarke to compete your order. Prices vary by style.

PDCU offers a few types of checking accounts, view all our Checking Account Options.

Construction Mortgage

If construction costs exceed the loan amount, you will be responsible for covering the additional expenses. It’s crucial to have a detailed budget and contingency plan to avoid running short on funds during construction.

Due to the increased risk involved, interest rates for construction loans are generally higher than for traditional mortgages. Rates can be variable or fixed and are determined based on your credit profile, loan amount, and market conditions.

Eligibility requirements can vary but typically include a good credit score, a stable income, a detailed construction plan, and a contract with a licensed builder. Some lenders may also require a down payment.

Construction loans can be used to cover the costs associated with building a new home. This includes land purchase (if not already owned), construction materials, labor, permits, and other related expenses.

A one-time close construction loan combines your construction financing and permanent mortgage into a single loan. You only have to go through the closing process once, saving you time and money on additional closing costs and paperwork.

Construction loans provide funds in stages as your home is being built. These funds are disbursed to your builder based on a pre-agreed schedule, often called “draws.” During construction, you typically make interest-only payments on the disbursed amounts. Once construction is complete, the loan transitions to a permanent mortgage, and you start making regular mortgage payments.

A construction mortgage loan is a type of loan specifically designed to finance the construction of a new home. It typically involves two phases: the construction phase, where the loan funds the building process, and the permanent mortgage phase, where the loan converts into a standard mortgage upon completion of the home.

- Copy of your driver’s license

- Last 2 years W2’s

- Most recent 30 days span of paystubs

- Last 2 years Federal Tax Returns

- Most recent two months bank statements, all pages

- Contact information for homeowner’s insurance agent

You may give us a call at 248-263-4100 to speak with the loan department.

Debit/ATM card

Contactless cards, offer several benefits over traditional cards that require a physical swipe or insertion into a card reader. Some of these benefits include:

- Speed: Contactless cards can be scanned quickly and easily, making transactions faster and more efficient. This can be especially useful in high-traffic retail environments where lines are lengthy.

- Convenience: Contactless cards do not require a physical swipe or insertion, which can be particularly useful for people on the go, such as commuters or people running errands.

- Increased security: Contactless cards can reduce the risk of fraud because they use near-field communication (NFC) technology, which creates a secure connection between the card and the card reader. Additionally, the risk of card skimming is lowered because a contactless card doesn’t leave the cardholder’s possession.

- Reduced contact: Because contactless cards can be scanned without physical contact, they can help reduce the spread of germs and bacteria, which is especially important during a pandemic.

- Adoption: Contactless payments are becoming more widely adopted; it may be more convenient for cardholders to have contactless cards as many merchants are starting to accept them.

Contactless card transactions are generally faster and more convenient than traditional card transactions.

3 steps to take if your debit card was hacked

Keep a close eye on your account activity and report suspicious transactions immediately using this form. The sooner you tell us about any unauthorized debits or charges, the better off you’ll be.

1. Check your accounts for unauthorized charges or debits and continue monitoring your accounts

If you have online or mobile access to your accounts, check your transactions as frequently as possible. If you receive paper statements, be sure to open them and review them closely.

2. Report a suspicious charge or debit immediately

Contact us immediately if you suspect an unauthorized debit. If your physical credit card has not been lost you can protect yourself from being liable for unauthorized debit card charges by reporting those charges immediately after you find out about them. If you spot a fraudulent transaction, complete this form and return it.

3. Know when to ignore anyone contacting you to “verify” your account information by phone or email

This could be a common scam, often referred to as “phishing,” to steal your account information. We never ask for account information through phone or email that they initiate. If you receive this type of contact, you should immediately call People Driven Credit Union at (248) 263-4100. For more information on phishing scams, check out the FTC’s consumer alerts . For more information, check out consumer advisory. & IDENTITY THEFT AND FRAUD

In some cases we may restrict a card from being capable of completing an ATM deposit. Please give us a call at 844-700-7328 if you are having trouble making a deposit.

Please give us a call at 844-700-7328 or visit a branch to order a new card. Cards take up to 10 business days to arrive in the mail.

YES! Your card may get declined if you are out of state or out of the country. Please give us a call during business hours at 844-700-7328 and speak with a rep or coming into a branch.

You may also log into online banking and send the credit union a secure message! Please let us know where you will be traveling, dates leaving and returning and a good phone number.

Please give us a call during business hours at 844-700-7328 and speak with a rep or come into a branch.

Please call 866-762-0558 from your primary phone number on your membership to activate your card.

To report a lost or stolen card during our business hours please call 844-700-7328 and a People Driven rep shall assist. After hours please call 888-241-2510. In the event you need to call the after hours number, please give us a call during our office hours the following business day so we may place an order of a new card.

Fannie Mae Fixed Rate Mortgage

A Fannie Mae Fixed Rate Mortgage Loan is a home loan with a fixed interest rate that remains the same throughout the life of the loan. It is backed by Fannie Mae and offers predictable monthly payments, making it a popular choice for homebuyers seeking stability and long-term planning.

Eligibility for a Fannie Mae Fixed Rate Mortgage Loan typically requires a good credit score, a stable income, and a manageable level of debt. Specific eligibility requirements can vary, so it’s best to contact People Driven Credit Union for detailed information.

Apply online or contact our mortgage specialist, Jim Rogers, who will guide you through the application process, help you understand your options, and determine your eligibility.

James (Jim) Rogers is authorized to act as an agent on behalf of People Driven Credit Union. Contact him for personalized assistance with your mortgage needs.

Jim Rogers

Member First Mortgage

james.rogers@memberfirstmortgage.com

(616) 301.6278 | NMLS ID# 235651

Down payment requirements for a Fannie Mae Fixed Rate Mortgage Loan can vary, but typically range from 3% to 20% of the home’s purchase price. Lower down payments may require private mortgage insurance (PMI).

The minimum credit score for a Fannie Mae Fixed Rate Mortgage Loan is usually around 620. However, higher credit scores can help you qualify for better interest rates and terms.

Schedule an Appointment

Schedule an appointment at one of our branches for a variety of services, including opening new accounts or membership, getting assistance with card services like issuing a new debit card or applying for a credit card, and applying for loans or mortgages. We also offer support for online and mobile banking, IRA account services, and notary services. Book an appointment today for personalized, one-on-one assistance from our team.

Eligible properties include single-family homes, condominiums, and multi-unit properties (up to four units). The property must be used as your primary residence.

Common loan terms for Fannie Mae Fixed Rate Mortgages are 15, 20, and 30 years. The term you choose will affect your monthly payments and the total interest paid over the life of the loan.

- Predictable Monthly Payments: Your interest rate and monthly payments remain the same throughout the life of the loan.

- Stability: Fixed rates provide financial stability and simplify long-term budgeting.

- Flexibility: Available for various property types and occupancy situations.

Yes, refinancing with a Fannie Mae Fixed Rate Mortgage can help you secure a lower interest rate, reduce your monthly payments, or change your loan term to better suit your financial goals.

Apply online or contact our mortgage specialist, Jim Rogers, who will guide you through the application process, help you understand your options, and determine your eligibility.

James (Jim) Rogers is authorized to act as an agent on behalf of People Driven Credit Union. Contact him for personalized assistance with your mortgage needs.

Jim Rogers

Member First Mortgage

james.rogers@memberfirstmortgage.com

(616) 301.6278 | NMLS ID# 235651

- Copy of your driver’s license

- Last 2 years W2’s

- Most recent 30 days span of paystubs

- Last 2 years Federal Tax Returns

- Most recent two months bank statements, all pages

- Contact information for homeowner’s insurance agent

FHA Mortgage

An FHA Mortgage Loan is a home loan insured by the Federal Housing Administration (FHA), designed to help low-to-moderate-income borrowers qualify for financing. These loans are particularly beneficial for first-time homebuyers or those with lower credit scores.

- Lower Down Payment: FHA loans allow for a down payment as low as 3.5% of the purchase price.

- Flexible Credit Requirements: Borrowers with lower credit scores may still qualify for an FHA loan.

- Competitive Interest Rates: FHA loans often offer lower interest rates compared to conventional loans.

- Assumable Loan: The loan can be transferred to a new buyer if you decide to sell your home.

- Refinancing Options: Streamlined refinancing options are available to reduce your interest rate or adjust your loan term.

Eligibility for an FHA loan generally depends on your credit score, income, debt-to-income ratio, and the amount of down payment you can make. FHA loans are aimed at helping low-to-moderate-income borrowers and those with less-than-perfect credit.

The minimum credit score for an FHA loan is typically 580 with a 3.5% down payment. Borrowers with credit scores between 500 and 579 may still qualify with a higher down payment of 10%.

The amount you can borrow with an FHA loan depends on the FHA loan limits in your area, which vary by county. These limits are updated annually by the FHA.

The minimum down payment for an FHA loan is 3.5% of the purchase price for borrowers with a credit score of 580 or higher. Borrowers with credit scores between 500 and 579 are required to make a down payment of at least 10%.

Yes, the FHA offers a loan program called the FHA 203(k) Rehabilitation Loan, which allows you to finance both the purchase of a home and the cost of its repairs through a single mortgage.

FHA loans can be used to finance a variety of properties, including single-family homes, multi-family properties (up to four units), condos, and certain manufactured homes.

In addition to the down payment, FHA loans require mortgage insurance premiums (MIP). There is an upfront MIP, typically 1.75% of the loan amount, and an annual MIP, which is paid monthly and varies based on the loan term and amount.

Apply online or contact our mortgage specialist, Jim Rogers, who will guide you through the application process, help you understand your options, and determine your eligibility.

James (Jim) Rogers is authorized to act as an agent on behalf of People Driven Credit Union. Contact him for personalized assistance with your mortgage needs.

Jim Rogers

Member First Mortgage

james.rogers@memberfirstmortgage.com

(616) 301.6278 | NMLS ID# 235651

Freddie Mac Fixed Rate Mortgage

A Freddie Mac Fixed Rate Mortgage Loan is a home loan with an interest rate that remains constant throughout the life of the loan. It is backed by Freddie Mac and provides borrowers with predictable monthly payments, making it easier to budget and plan for the future.

Eligibility for a Freddie Mac Fixed Rate Mortgage Loan typically includes having a stable income, a good credit score, and a manageable debt-to-income ratio. Specific eligibility criteria can vary, so it’s best to contact People Driven Credit Union for personalized information.

Down payment requirements can vary, but typically range from 3% to 20% of the home’s purchase price. Lower down payments may require private mortgage insurance (PMI).

The minimum credit score required is generally around 620, but higher credit scores can help you qualify for better interest rates and loan terms.

Eligible properties include single-family homes, condominiums, and multi-unit properties (up to four units). The property must be used as your primary residence.

Common loan terms include 15, 20, and 30 years. The term you choose will affect your monthly payments and the total interest paid over the life of the loan.

- Predictable Monthly Payments: Your interest rate and monthly payments remain the same throughout the life of the loan.

- Stability: Fixed rates provide financial stability and simplify long-term budgeting.

- Flexibility: Available for various property types and occupancy situations.

Yes, refinancing with a Freddie Mac Fixed Rate Mortgage can help you secure a lower interest rate, reduce your monthly payments, or change your loan term to better suit your financial goals.

PMI is insurance that protects the lender if you default on your mortgage. It is typically required if your down payment is less than 20% of the home’s purchase price. PMI can be canceled once you have enough equity in your home.

Apply online or contact our mortgage specialist, Jim Rogers, who will guide you through the application process, help you understand your options, and determine your eligibility.

James (Jim) Rogers is authorized to act as an agent on behalf of People Driven Credit Union. Contact him for personalized assistance with your mortgage needs.

Jim Rogers

Member First Mortgage

james.rogers@memberfirstmortgage.com

(616) 301.6278 | NMLS ID# 235651

General

To request a skip-a-pay on a People Driven Credit Union mortgage, please get in touch with your mortgage processor, who is currently servicing the mortgage payments. If your mortgage application was processed by:

- Member First Mortgage call (866) 898-1818 OR contact a Payment Solution Specialist (248) 263-4100

- TowneMortgage (formerly known as Americu) call (888) 778-9700

- Mortgage Center call (800) 353-4449

Who do I contact about signing a loan that is in process?

If you are already working with a Lending Specialist, they can walk you through signing your documents electronically. This can be done from within online banking. You can also reach out to us at (248)263-4100, and one of our specialists will be able to assist you.

Can I still apply for a loan?

Yes. While we have adjusted how we serve you, you can still apply for a loan or credit card online through our website.

I’m financially impacted by the Coronavirus and may be unable to make my next loan payment(s). What should I do?

Rest assured, we’re in this together and here for you. We will be here to provide the financial assistance you need. For starters, we’ve waived the fee on our Skip-A-Payment program, which allows members with eligible loans to skip up to two monthly loan payments so they can keep up with other financial responsibilities. You can complete our Skip-A-Payment form, complete the application in online banking under the services tab, or call us at (248) 263-4100.

Again, if you or your family are experiencing financial hardship because of the current public health situation, we can help; tell us what you need.

Will my online bill payment be posted as scheduled?

Yes. All online bill payments will be processed as scheduled.

Do I still have access to my funds if they come in through direct deposit?

Yes. Your funds will be deposited as expected. You can access your funds via online banking and the People Driven Credit Union app. You can withdraw cash at ATMs and through drive-thru service at local branch centers.

Who do I contact about card disputes and fraud?

Please call our Member Center at (248) 263-4100 and speak with a team member to dispute any charges or report fraudulent activity.

How do I get a replacement debit or credit card?

Call us at (248) 263-4100, and a team member will work with you to get a replacement card sent directly to you. We have recently added debit card controls inside our phone app.

Is my money safe?

Yes! Your deposits are safe. Your deposits are insured through the National Credit Union Administration (NCUA), which means you can keep your money here with complete confidence that it will always be here when needed.

I need to withdraw cash. What are my options?

Rest assured, just because our branch lobbies are closed does not mean you cannot access your money. Your cash may be withdrawn via drive-thru lanes during our regular business hours and by ATM 24/7. To find a surcharge-free ATM near you, click here.

How do I deposit cash?

You can make cash deposits via drive-thru lanes during our regular business hours and at most ATMs.

How do I deposit a check?

You can make check deposits via drive-thru lanes during our regular business hours, at ATMs, and, most conveniently, via the mobile deposit feature of our mobile app.

Are People Driven Credit Union branches staying open?

We will remain open to serve you by drive-thru only during normal business hours. You can call us with any questions at (248) 263-4100. (Our McNamara Branch is Temporarily closed)

When will People Driven Credit Union re-open branch lobbies?

As a community partner, we want to do our part to care for our members. As further information is available, we plan to follow CDC guidelines and best practices. At this time, we do not have an estimated date to re-open our lobbies. We’ll communicate this date/time as soon as possible!

Can I still open an account?

Absolutely. While we have adjusted how we serve you at our branches, you can open an account online anytime.

Please give us a call at 248-263-4100 or toll free at 844-700-7328 and speak with a representative to assist you.

iTalk Telephone Teller is a free telephone banking service. Check your account balances, see if a check has cleared, transfer money between accounts, check your loan balance, make loan payments from checking or savings, or request a statement be mailed to you, etc. Please dial us toll-free at 844-700-7328 or call us at 248-263-4100 and choose option 1.

Visit Love My Credit Union Rewards to view all your perks such as discounts at Sprint, Trustage insurance and turbotax!

Home Equity Line of Credit (HELOC)

Loan-to-Value Ratio (LTV) is a measure of the amount of the loan compared to the appraised value of the property. It is calculated by dividing the loan amount by the appraised value or purchase price of the property, whichever is lower, and is expressed as a percentage.

How is LTV Calculated?

The formula to calculate LTV is:

LTV = (Loan Amount / Appraised Value of the Property) × 100

For example, if you want to borrow $150,000 to buy a house that appraises for $200,000, the LTV would be:

LTV = ($150,000 / $200,000) × 100 = 75%

Why is LTV Important?

- Risk Assessment: Lenders use the LTV ratio to assess risk. A lower LTV ratio means less risk for the lender because the borrower has more equity in the property.

- Interest Rates: Higher LTV ratios often result in higher interest rates because the loan is considered riskier.

- Loan Approval: Some loans have maximum LTV ratios. For instance, conventional loans typically require an LTV of 80% or less to avoid private mortgage insurance (PMI).

- Borrower Equity: The LTV ratio gives borrowers an idea of how much equity they have in their property. Higher equity can lead to better loan terms.

Typical LTV Ratios

- Conventional Loans: Generally, lenders prefer an LTV of 80% or lower.

- FHA Loans: These can allow for higher LTV ratios, often up to 96.5%.

- VA Loans: These can have LTV ratios up to 100%.

Impact on Home Equity Loans and HELOCs

For Home Equity Loans and Home Equity Lines of Credit (HELOCs), lenders often require a combined loan-to-value (CLTV) ratio, which includes the first mortgage and the home equity loan or line of credit. A typical CLTV requirement might be 85% or lower.

Understanding the LTV ratio is crucial for both lenders and borrowers, as it affects loan approval, terms, and the overall cost of borrowing.

If you cannot repay your HELOC according to the terms, you risk foreclosure on your home, as the property is collateral for the loan. It’s essential to borrow responsibly and within your means.

In many cases, the interest paid on a HELOC may be tax-deductible if the funds are used for home improvements or other qualifying expenses. Consult with a tax advisor to understand your specific tax implications.

Yes, there may be fees associated with a HELOC, such as an application fee, annual fee, closing costs, or early closure fee. It’s essential to review the terms and conditions of the HELOC agreement to understand the fees involved.

The amount you can borrow with a HELOC depends on factors such as the equity in your home, your creditworthiness, and the lender’s policies. Typically, you can borrow up to a certain percentage (e.g., 80-90%) of your home’s appraised value minus any outstanding mortgage balance.

HELOC funds can be used for various purposes, such as home improvements, debt consolidation, education expenses, major purchases, or emergencies. It provides flexibility to access funds when needed.

The interest rate on a HELOC is typically variable and may be based on an index, such as the prime rate, plus a margin determined by your creditworthiness. This means your payments can fluctuate based on market conditions.

The draw period is the initial period (typically 5-10 years) during which you can access funds from your HELOC and make interest-only payments. After the draw period ends, you enter the repayment period, in which you pay back both principal and interest.

Unlike a home equity loan, which provides a lump sum of money with fixed payments, a HELOC offers a revolving credit line with a draw period during which you can borrow and repay funds as needed. You only pay interest on the amount you borrow.

A HELOC is a revolving line of credit that uses your home as collateral. It allows you to borrow funds as needed, up to a predetermined credit limit, using the equity you’ve built in your home.

Home Equity Loan

Loan-to-Value Ratio (LTV) is a measure of the amount of the loan compared to the appraised value of the property. It is calculated by dividing the loan amount by the appraised value or purchase price of the property, whichever is lower, and is expressed as a percentage.

How is LTV Calculated?

The formula to calculate LTV is:

LTV = (Loan Amount / Appraised Value of the Property) × 100

For example, if you want to borrow $150,000 to buy a house that appraises for $200,000, the LTV would be:

LTV = ($150,000 / $200,000) × 100 = 75%

Why is LTV Important?

- Risk Assessment: Lenders use the LTV ratio to assess risk. A lower LTV ratio means less risk for the lender because the borrower has more equity in the property.

- Interest Rates: Higher LTV ratios often result in higher interest rates because the loan is considered riskier.

- Loan Approval: Some loans have maximum LTV ratios. For instance, conventional loans typically require an LTV of 80% or less to avoid private mortgage insurance (PMI).

- Borrower Equity: The LTV ratio gives borrowers an idea of how much equity they have in their property. Higher equity can lead to better loan terms.

Typical LTV Ratios

- Conventional Loans: Generally, lenders prefer an LTV of 80% or lower.

- FHA Loans: These can allow for higher LTV ratios, often up to 96.5%.

- VA Loans: These can have LTV ratios up to 100%.

Impact on Home Equity Loans and HELOCs

For Home Equity Loans and Home Equity Lines of Credit (HELOCs), lenders often require a combined loan-to-value (CLTV) ratio, which includes the first mortgage and the home equity loan or line of credit. A typical CLTV requirement might be 85% or lower.

Understanding the LTV ratio is crucial for both lenders and borrowers, as it affects loan approval, terms, and the overall cost of borrowing.

A Second Mortgage is a loan that is secured by your home in addition to your primary mortgage. It allows you to borrow against the equity you’ve built up in your home.

A Fixed Term Home Equity Loan provides you with a lump sum of money, which you repay over a fixed period with a set interest rate. This makes your monthly payments predictable.

You can use a Home Equity Loan for various purposes, including home improvements, debt consolidation, education expenses, medical bills, or major purchases.

- Predictable Payments: Fixed monthly payments make budgeting easier.

- Lower Interest Rates: Generally lower than unsecured loans due to the home serving as collateral.

- Lump Sum: Access to a large amount of money upfront.

- Foreclosure: If you default on the loan, the lender can foreclose on your home.

- Increased Debt: Taking on a second mortgage increases your overall debt load.

The amount you can borrow is typically determined by your home’s equity, which is the difference between your home’s current market value and the balance of your first mortgage.

Eligibility requirements for home equity loans include having sufficient home equity, a good credit score, a stable income, and a favorable debt-to-income ratio.

Interest on a Fixed Term Home Equity Loan is typically calculated as a fixed percentage of the loan amount, and it remains constant throughout the life of the loan.

Interest on a Home Equity Loan may be tax-deductible if the loan is used for home improvements, but it’s best to consult a tax advisor for specific guidance.

Home Possible Mortgage

A Home Possible® Mortgage Loan is a flexible and affordable loan program from Freddie Mac designed to help low-to-moderate income borrowers and first-time homebuyers achieve homeownership. It features low down payment requirements and flexible credit terms.

Home Possible® Mortgage Loans are available to creditworthy low-to-moderate income borrowers. Income limits typically apply, and your income must generally be at or below 80% of the area median income (AMI) for the location of the property. The program is open to both first-time and repeat homebuyers.

The minimum down payment required for a Home Possible® Mortgage is as low as 3% of the home’s purchase price. This low down payment option makes it easier to afford a new home without a large upfront cost.

Yes, Home Possible® allows you to use gift funds from relatives, friends, or other eligible sources for your down payment and closing costs. Grants and down payment assistance programs can also be used.

Home Possible® Mortgages can be used to finance various types of properties, including single-family homes, condominiums, and multi-unit properties (up to four units). The property must be used as your primary residence.

The minimum credit score required for a Home Possible® Mortgage is typically 620. However, having a higher credit score can improve your chances of qualifying and securing better interest rates.

Your debt-to-income ratio should generally not exceed 50%. This means that your total monthly debt payments, including your new mortgage, should be 50% or less of your gross monthly income.

Yes, Home Possible® requires first-time homebuyers to complete a homeownership education course from an approved provider, such as CreditSmart. This course helps prepare you for the responsibilities of homeownership and provides valuable financial insights.

Yes, Home Possible® offers refinancing options that can help you take advantage of lower interest rates and better loan terms.

Home Possible® offers numerous benefits, including low down payment options, flexible underwriting standards, competitive interest rates, and the ability to use various sources of funds for down payments. It also promotes financial literacy through required homeownership education.

Home Renovation Loans

Maximize your savings with potential tax deductions on the interest paid on your Home Renovation Loan. Consult with a tax advisor to explore the tax benefits available to you.

When applying for a Home Renovation Loan, prepare for your renovation journey by gathering proof of income, identification, and details about your planned renovation project.

Yes, you can conveniently apply for a Home Renovation Loan online through our website or by visiting one of our branches.

With our streamlined application process, approval for your Home Renovation Loan is fast and efficient, so you can start your renovation project without delay.

Enjoy flexible repayment terms of up to 84 months (7 years) with our Home Renovation Loan, giving you ample time to repay without straining your budget.

At People Driven Credit Union, you can secure up to $30,000 with our Home Renovation Loan, providing you with the financial flexibility to tackle projects big and small.

With a Home Renovation Loan, the possibilities are endless. You can revamp your kitchen, refresh your bathroom, upgrade your flooring, enhance your outdoor space, or even invest in energy-efficient upgrades to lower your utility bills.

You can use a Home Renovation Loan to fund a variety of home improvement projects, including:

- Kitchen or bathroom remodeling

- Flooring replacement

- Roof repairs or replacement

- HVAC system upgrades

- Painting and cosmetic enhancements

- Deck or patio installation

- Energy-efficient upgrades (e.g., new windows or insulation)

A Home Renovation Loan is the key to transforming your home into your dream space. Tailored specifically for home improvement projects, this loan allows you to access a lump sum upfront to bring your renovation plans to life.

You may give us a call at 248-263-4100 to speak with the loan department.

Yes! All eligible loans can be skipped once per calendar year for a fee of $35.

Fresh Start Auto Loans, Lines of Credit, Mortgages, Commercial Loans, and Credit Cards are excluded.

HomeReady Mortgage

A HomeReady® Mortgage Loan is a flexible, affordable loan program from Fannie Mae designed to help low-to-moderate income borrowers and first-time homebuyers achieve homeownership. It features low down payment requirements and flexible underwriting standards to make buying a home more accessible.

HomeReady® Mortgage Loans are available to creditworthy low-to-moderate income borrowers. Income limits typically apply, and your income must generally be at or below 80% of the area median income (AMI) for the location of the property. The program is open to both first-time and repeat homebuyers.

The minimum down payment required for a HomeReady® Mortgage is as low as 3% of the home’s purchase price. This low down payment option makes it easier to afford a new home without a large upfront cost.

Yes, HomeReady® allows you to use gift funds from relatives, friends, or other eligible sources for your down payment and closing costs. Grants and down payment assistance programs can also be used.

HomeReady® Mortgages can be used to finance various types of properties, including single-family homes, condominiums, and multi-unit properties (up to four units). The property must be used as your primary residence.

The minimum credit score required for a HomeReady® Mortgage is typically 620. However, having a higher credit score can improve your chances of qualifying and securing better interest rates.

Yes, HomeReady® requires first-time homebuyers to complete a homeownership education course from an approved provider, such as Framework. This course helps prepare you for the responsibilities of homeownership and provides valuable financial insights.

Yes, HomeReady® offers refinancing options that can help you take advantage of lower interest rates and better loan terms.

Schedule an Appointment

Schedule an appointment at one of our branches for a variety of services, including opening new accounts or membership, getting assistance with card services like issuing a new debit card or applying for a credit card, and applying for loans or mortgages. We also offer support for online and mobile banking, IRA account services, and notary services. Book an appointment today for personalized, one-on-one assistance from our team.

HomeReady® offers numerous benefits, including low down payment options, flexible underwriting standards, competitive interest rates, and the ability to use various sources of funds for down payments. It also promotes financial literacy through required homeownership education.

Apply online or contact our mortgage specialist, Jim Rogers, who will guide you through the application process, help you understand your options, and determine your eligibility.

James (Jim) Rogers is authorized to act as an agent on behalf of People Driven Credit Union. Contact him for personalized assistance with your mortgage needs.

Jim Rogers

Member First Mortgage

james.rogers@memberfirstmortgage.com

(616) 301.6278 | NMLS ID# 235651

Investments

A Money Market Savings Account is a type of savings account that generally offers higher interest rates than regular savings accounts. It also has some checking account features, like limited check writing.

Money Market Accounts typically offer higher interest rates and allow for limited check writing or transfers, making them more flexible for larger balances than standard savings accounts.

At People Driven Credit Union, the Money Market Savings Account requires a minimum deposit of $1,000 to open.

Interest on a Money Market Account is calculated daily based on the account balance and is paid and compounded monthly, allowing your savings to grow faster.

Yes, federal regulations allow up to six (6) preauthorized withdrawals or transfers per statement cycle with a Money Market Account, including check writing and electronic transfers.

Yes, People Driven’s Money Market Savings Accounts allow for six (6) preauthorized transfers or withdrawals per statement cycle.

Yes, funds in Money Market Accounts at People Driven Credit Union are Federally insured to at least $250,000 by the NCUA and backed by the full faith and credit of the United States Government.

Fees may apply if minimum balance requirements are unmet or the number of allowable transactions is exceeded. For more details, refer to the fee schedule provided by People Driven Credit Union.

You can open a Money Market Savings Account by visiting People Driven Credit Union in person, filling out the forms online, or, if you’re a current PDCU member, using the MyPDCU app to open your account.

An IRA Variable Rate Savings Account is a retirement savings option that offers tax-advantaged growth with a flexible, variable interest rate. This account can be opened as a Traditional, Roth, or Educational IRA, depending on your tax and savings goals.

IRA Certificates of Deposit

Educational IRA vs. 529

An Educational IRA, known as a Coverdell Education Savings Account (ESA), and a 529 Plan are both tax-advantaged savings options for educational expenses, but they differ in several important ways:

1. Contribution Limits

- Coverdell ESA: Annual contribution is capped at $2,000 per beneficiary.

- 529 Plan: Contribution limits are generally much higher, often exceeding $300,000, depending on the plan and state.

2. Use of Funds

- Coverdell ESA: Funds can be used for both K-12 education and college expenses, covering tuition, books, supplies, and even certain tutoring services.

- 529 Plan: Primarily designed for college expenses, but recent tax law changes allow up to $10,000 per year to be used for K-12 tuition.

3. Income Limitations

- Coverdell ESA: There are income restrictions for contributors. Individuals earning more than $110,000 (or couples earning more than $220,000) may not contribute.

- 529 Plan: No income restrictions apply to contributions, making it more accessible to a broader range of contributors.

4. Control and Investment Options

- Coverdell ESA: Offers more flexibility in investment choices, allowing account holders to choose from various stocks, bonds, or mutual funds.

- 529 Plan: Investment options are generally limited to a selection provided by the state or plan administrator, often with age-based portfolios that adjust risk over time.

5. Ownership and Control of Funds

- Coverdell ESA: If funds aren’t used for education, the account must be transferred to the child when they turn 30.

- 529 Plan: The account owner retains control over the funds indefinitely, and there’s no age limit for the beneficiary to use the funds.

6. Tax Benefits

- Both accounts grow tax-free, and qualified withdrawals for education expenses are also tax-free.

In summary, the Coverdell ESA offers flexibility in investment options and covers a broader range of K-12 expenses. At the same time, the 529 Plan has higher contribution limits and no income restrictions and is more commonly used for college savings.

The difference between the Dividend Rate and APY (Annual Percentage Yield) lies primarily in considering compounding. Here’s a breakdown:

Interest Rate

- Definition: The interest rate is the nominal rate at which interest is paid on the principal amount.

- Compounding: It does not account for how often interest is compounded. It is simply the rate without considering the effects of compounding within the period.

- Usage: Often quoted as an annual rate, but it can be applied over different compounding periods (monthly, quarterly, etc.).

Dividend Rate

- Definition: Similar to the interest rate, but typically used by credit unions or certain investment accounts to describe the rate paid on deposits or investments.

- Compounding: Like the interest rate, it does not account for the compounding frequency.

APY (Annual Percentage Yield)

- Definition: APY reflects the total amount of interest earned on an account in a year, accounting for the effect of compounding interest.

- Compounding: It includes the effects of compounding interest. Which means it shows the real return on investment or savings over a year.

- Formula: The formula for APY is:

APY = (1 + r/n)^n - 1