Bridge Gaps with a Personal Line of Credit

Looking for a flexible, convenient way to manage life’s financial ups and downs? Your solution could be a Personal Line of Credit from People Driven Credit Union (PDCU). Unlike a traditional loan, a Personal Line of Credit gives you ongoing access to funds up to an approved limit, and you only pay interest on the amount you use. Whether you need to cover unexpected expenses, handle a home project, or have a safety net for life’s surprises, our Personal Lines of Credit are designed to help you stay in control. With specialized rates for members, personalized service, and the ability to access funds at your convenience, PDCU’s Personal Lines of Credit may offer the financial flexibility you deserve.

Membership and eligibility requirements apply, with approval subject to application, credit, and vessel considerations.

Personal Lines of Credit

A personal line of credit is a revolving credit option that works like a credit card but typically offers higher limits and lower interest rates. You can borrow up to a pre-approved amount for any purpose—home renovations, medical bills, or travel—and you only pay interest on what you actually use. As you repay the principal, your available credit replenishes, giving you ongoing access to funds.

Unlike a traditional personal loan, there’s no fixed repayment schedule, so you can pay at your own pace. People Driven Credit Union, a full-service institution with conveniently located branches and ATMs across Metro Detroit and Southeast Michigan, makes it easy to get started with a personal line of credit that fits your needs.

PLOC Advantages

- Only pay interest on money when you need it

- If your income fluctuates, a credit line can cover bills during slow times

- Interest rates can be lower than most credit cards rates (depending on credit rating)

- Easily transfer money when needed using our mobile app

- A personal line of credit can be a great source for an emergency fund

- Having a separate loan account (instead of credit cards) may help you stick to a budget or control your spending.

Overdraft Line of Credit (ODLOC)

Tired of worrying about overdraft fees or declined transactions? An Overdraft Line of Credit (ODLOC) from People Driven Credit Union gives you a safety net by automatically covering any shortfall in your checking account.

Think of it as a revolving line of credit specifically designed to protect you from unexpected expenses or timing mishaps. You pay interest only on the amount you use, and once you pay it back, your available credit replenishes—so you’re always prepared.

Overdraft Line of Credit (ODLOC) Advantages

- Protection Against Overdrafts

Prevent bounced checks, declined transactions, and overdraft fees by having a cushion to cover shortfalls in your checking account. - Flexible Access to Funds

Unlike a traditional loan, an ODLOC is a revolving line of credit—meaning you can use it whenever you need it, up to your approved limit. - Interest Only on What You Use

You don’t pay interest on the entire credit line, just the amount you actually draw to cover an overdraft. - Convenience

Funds are automatically transferred to your checking account when your balance isn’t sufficient, saving you from the embarrassment and hassle of denied transactions. - Credit Replenishes as You Repay

Once you repay the borrowed amount, your available credit bounces back, giving you ongoing overdraft protection.

Personal Line of Credit / Overdraft Line of Credit (ODLOC) Rate

|

Type |

Minimum Payment |

APR* |

| Line of Credit/Overdraft Protection (ODLOC) | 3% of Balance, $30 Mininum | 13.25% |

|

Rates Effective as of: |

||

Frequently Asked Questions

Contact a Representative

-

How long can I take to repay a Life Situational Loan? Terms are available up to 72 months, depending on the amount financed and approval.

-

What can I use a Life Situational Loan for? These loans may be used for eligible expenses tied to major life events, including wedding-related costs and funeral or memorial expenses.

-

Can I get a Life Situational Loan with bad credit? Yes. People Driven Credit Union considers more than just your credit score, including your income and credit history. If approved, funds are deposited into your checking or savings account. Interest rates are based on your credit rating.

-

What is AutoPay? AutoPay automatically withdraws your loan payment each month from your People Driven checking or savings account. It helps you stay on track and may qualify you for the special loan rate discount. Enrollment is handled by phone at 248-263-4100.

-

What is the Special Loan Rate Discount? The special loan rate discount is a 0.25% APR reduction when you set up AutoPay from your People Driven checking or savings account. The discount is already included in the advertised “as low as” rate. Enrollment is handled by phone at 248-263-4100.

Terms are available up to 72 months, depending on the amount financed and approval.

These loans may be used for eligible expenses tied to major life events, including wedding-related costs and funeral or memorial expenses.

You can quickly check your balance in the MyPDCU Mobile App. Just log in, select your Visa® Credit Card account, and you’ll see your current balance along with any past-due amount. Together, this shows your total amount owed.

When you open a Share Secured Credit Card, you agree to place a certain amount of money in a PDCU savings account as collateral. This deposit is held while the account is open and in good standing. If the account is closed and all balances are paid, the deposit is released back to you.

Yes. Your payment history is reported to major credit bureaus. Making on-time payments and keeping your balance low compared to your limit can help improve your credit profile over time.

Responsible use of a Share Secured Credit Card—such as making on-time payments and maintaining a low balance—may help you qualify for other PDCU credit card options. Approval is not guaranteed and is subject to credit review.

Yes. Your Share Secured Credit Card can be used anywhere Visa is accepted, including online and in person, subject to your available credit limit.

Interest and fees may apply. Please review our Credit Card Disclosures for complete details.

Contactless cards offer several benefits over traditional cards that require a physical swipe or insertion into a card reader. Some of these benefits include:

- Speed: Contactless cards can be scanned quickly and easily, resulting in faster and more efficient transactions. This can be especially useful in high-traffic retail environments where lines are lengthy.

- Convenience: Contactless cards eliminate the need for physical swiping or insertion, making them particularly useful for people on the go, such as commuters or those running errands.

- Increased security: Contactless cards reduce the risk of fraud by utilizing near-field communication (NFC) technology, which establishes a secure connection between the card and the card reader. Additionally, the risk of card skimming is reduced because a contactless card remains in the cardholder's possession.

- Reduced contact: Because contactless cards can be scanned without physical contact, they can help reduce the spread of germs and bacteria, which is especially important during a pandemic.

- Adoption: Contactless payments are becoming increasingly widespread; it may be more convenient for cardholders to have contactless cards, as many merchants are now accepting them.

Contactless card transactions are generally faster and more convenient than traditional card transactions.

- The 2025 Summertime PD Quick Cash Loan application is now closed.

- For the Summertime Cash Loan, visit Personal Loan Options You can also call us at (248) 263-4100 for assistance.

- Quick Cash Loan: No credit check is required.

- Summertime Cash Loan: Yes, standard credit review applies and may affect your interest rate and approval amount.

- Quick Cash Loan: Funds may be deposited into your account within minutes after approval.

- Summertime Cash Loan: Typically funded within 5 business days upon final approval and document signing.

- PD Quick Cash Summertime Loan: Up to $2,000, 9.99% interest rate, no credit check, $35 fee, available only to current members with qualifying direct deposit.

- PDCU Summertime Cash Loan: Up to $30,000, available to both members and non-members, with credit and membership approval.

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the PD Quick Cash Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

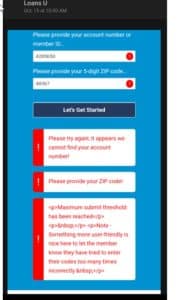

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.You can use a Home Improvement Loan for a wide range of projects, such as:

- Renovating a kitchen or bathroom

- Installing new windows or doors

- Adding a new room or extension

- Upgrading heating, ventilation, or air conditioning systems

- Repairing roofs or plumbing

- Improving energy efficiency with solar panels or insulation

To qualify, People Driven Credit Union will typically evaluate factors such as:

- Your credit score and credit history.

- Your income and employment status.

- Your debt-to-income ratio: Good credit and stable income improve your chances of approval and provide better loan terms.

Home Equity Loans for Borrowers With Bad Credit

A secured loan is a type of loan that requires collateral—such as a home, savings account, vehicle, or other valuable asset—to back the loan. For individuals with bad credit, secured loans, such as a home equity loan or home equity line of credit, can be a helpful option because the collateral reduces the lender’s risk, making approval more likely. By offering security, you may also qualify for better interest rates compared to unsecured loans. Plus, making timely payments on a secured loan can help improve your credit score over time. Keep in mind that if the loan isn’t repaid, the lender can claim the collateral to recover the balance. Talk to a PDCU lender to learn about your options.Improve Your Credit Score to Qualify for a Home Improvement Loan With Bad Credit

Improving your credit score before applying for a home loan can help you qualify for better rates and terms. Start by reviewing your credit report for errors and disputing any inaccuracies. Pay down existing debts, especially high-interest credit cards, and make all payments on time, as payment history is a key factor in your score. Avoid opening new credit accounts before applying for a mortgage, as this can lower your score temporarily. Taking these steps can strengthen your financial profile and increase your chances of securing a favorable home loan.- Home Improvement Loan: Typically, an unsecured personal loan, where you borrow a set amount to fund a home project, with fixed monthly payments and no collateral required.

- Home Equity Loan: A secured loan that uses the equity in your home as collateral, often offering larger loan amounts and lower interest rates than an unsecured loan.

- Lower Interest Rates: Because the loan is secured by your CD, the interest rates are typically lower than those of unsecured loans.

- Credit Building: A CD Secured Loan can help you build or improve your credit score through consistent, on-time payments.

- Preservation of Savings: You can access loan funds without breaking your CD and continue to earn interest on it.

- Credit card balances

- Personal loans

- Medical bills

- Debt Consolidation: This involves taking out a loan to pay off your existing debts, leaving you with one manageable payment. You are responsible for repaying the full amount of the loan.

- Debt Settlement: Involves negotiating with creditors to reduce the amount of debt you owe, often resulting in a negative impact on your credit score. Debt consolidation, on the other hand, typically helps preserve or improve your credit score.

A personal loan can impact your credit score in several ways:

- Positive Impact: Making on-time payments can improve your credit score.

- Negative Impact: Missing payments or defaulting on the loan can harm your credit score. Additionally, applying for a loan results in a hard inquiry, which may temporarily lower your score.

Personal loans can be used for a variety of purposes, including:

- Debt consolidation

- Home improvements

- Medical expenses

- Major purchases (e.g., appliances, electronics)

- Special events (e.g., weddings, vacations)

- Emergency expenses

- Secured Personal Loan: Requires collateral (e.g., a car or savings account). Offers lower interest rates due to reduced risk for the lender.

- Unsecured Personal Loan: Does not require collateral. The interest rate is based on your creditworthiness and may be higher than secured loans.

The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

A one-time $35 processing fee applies, regardless of loan amount.

- Kitchen or bathroom remodeling

- Flooring replacement

- Roof repairs or replacement

- HVAC system upgrades

- Painting and cosmetic enhancements

- Deck or patio installation

- Energy-efficient upgrades (e.g., new windows or insulation)

Using your People Driven Credit Union contactless debit card is quick, secure, and touch-free.

- Tap your card on the payment terminal where you see the symbol.

- Hold it for a second or two—you’ll hear a beep or see a green light when the payment goes through.

- That’s it! No need to insert, swipe, or touch the terminal beyond the tap.

It’s a fast way to pay—and your card never leaves your hand, adding an extra layer of protection.

Watch the video above to see just how easy it is.

United Concordia Dental is pleased to serve the dental insurance needs of People Driven Credit Union members and their families. People Driven Credit Union and United Concordia are partners because we care about your and your family's oral health.

Oral health problems often tax the immune system, exposing you to a greater risk of illness and infection. To help maintain a healthier smile and a healthier you, we encourage you to follow the advice of your dentist and the American Dental Association. Your dental plan emphasizes preventive care to help avoid costly procedures commonly caused by delayed treatment.

What plans are available? - People Driven Credit Union members have the choice of three plan options, including Concordia Plus MI 20 Series(DHMO), Concordia Plus MI 40 Series (DHMO), or Concordia Flex (FFS).

- Both Concordia Plus plans are managed care plans that require you to pre-select a primary dental office (PDO) from our Concordia Plus network for each of your covered family members and yourself. Each family member may select a different PDO. These plans reduce out-of-pocket costs as they feature no deductibles or annual maximum.

- Concordia Flex is a fee-for-service (FFS) plan that provides access to many practicing locations through our Advantage Plus network. Suppose your dentist does not currently participate in our network. In that case, you may still use your dentist, but your out-of-pocket expenses will likely be higher. Visiting one of our network dentists helps lower out-of-pocket costs and eliminates the need to fill out claim forms.

The plans include the Davis Vision Discount Program, which offers discounts on eye exams, eyewear, and laser vision correction. See the Davis Vision Discount Program flyer for more information.

How do I find a dentist? - If you would like to locate a participating dentist or check on the participation status of your current dentist, click on the button below:

Search for a Concordia Plus Dentist

What if I have a question? - If you have a question about your dental benefits prior to being enrolled in the program, email United Concordia Dental Customer Service or call the appropriate toll-free Customer Service number. After you are enrolled, visit My Dental Benefits for online access to your benefits detail, claim history, claim status, eligibility information and more!

If your People Driven Credit Union Visa Rewards Driven Credit Card is lost or stolen, or if you suspect unauthorized use, notify us immediately. "Unauthorized use" refers to any use of the card by someone without your permission, where you receive no benefit.

To report your Rewards Driven Credit Card as lost or stolen, call us at 844-700-7328 immediately.

After hours ONLY: Report a lost or stolen People Driven Credit Union Visa Rewards Driven Credit Card by calling 800-543-5073.

After your call, please follow up with a written notice to:

Credit Card Security Department PO Box 30035 Tampa, FL 33630

We may ask for your help in investigating the loss or unauthorized use. Your liability for unauthorized charges will only apply if it can be proven that you were negligent in handling the card or if you engaged in fraudulent use.

To report a lost or stolen PDCU ATM or Visa Debit Card, visit our FAQs on ATM/Debit card loss or theft.

There are several convenient ways to make a payment on your People Driven Visa Credit Card:

- Online: Log into online banking, select "Transfer," choose the account you're transferring from, and select your Visa card as the transfer destination. You can also set up automatic payments to ensure you never miss a due date.

- Mobile App: Make payments directly through the PDCU mobile app.

- By Phone: Call 844-700-7328 to make a payment with a debit card or have a representative transfer a payment from your PDCU savings or checking account.

- By Mail: You can mail your payment to:

- People Driven Credit Union 24333 Lahser Rd Southfield, MI 48033

- Or to PO BOX 984 Southfield, MI 48037

- In Person: Visit any PDCU branch to make your payment in person.

Setting up automatic payments will ensure you never miss a due date, and you can change the frequency to suit your needs.

- To make a payment via online banking with funds already in your account, login to the MyPDCU Online Portal or use the MyPDCU app, and select 'transfers'. Select where you want to transfer from and which loan you would transfer to.

- To make a payment with a debit/credit card, call (248) 263-4100.

- Set up an auto-transfer from your People Driven account or attach an auto payment to your direct deposit that comes into your account. Give us a call at (248) 263-4100 or stop by any of our five branches.

- Have us set up an auto-payment from your other financial institution. Please call us at (248) 263-4100, and we can send you the proper form, or you may stop by any of our five branches.

- You may also mail in a check payable to People Driven Credit Union, 24333 Lahser Rd, Southfield, MI 48033

We recently had a death in the family, The Team at PDCU was kind, caring and emphatic.

Ernie Member since 2018

Disclosures

*APR = Annual Percentage Rate: The actual APR and loan term is subject to approval and may be determined upon the borrower’s creditworthiness, the amount borrowed, and the type, value, age, and condition of the collateral offered to secure the loan (when applicable). Rates are effective as of today and are subject to change.

¹Special Loan Rate Discount: Benefit from a .25% reduction when enrolling in our autopay service, which is included in the “as low as” rate advertised. The discount is available to those who setup autopay of their monthly loan payment from a People Driven Credit Union checking or savings account.

People Driven Credit Union is an Equal Housing Opportunity Lender NMLS #776727

All other trademarks are the property of their respective owners.

You Might Also Be Interested In...

-

Mortgage Refinance

Why not bundle all your debt into a low-interest rate and improve monthly cash flow.

-

Auto Refinance

Auto refinancing could score you a lower interest rate. As a result, it could decrease your monthly payments and free up cash for other financial obligations.

-

Member Reward Offers

We believe our members deserve to be rewarded. That is why PDCU rewards you for all types of activity.